Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

From Tax Cuts for the Rich to Cuts to Vital Programs for Women and Families

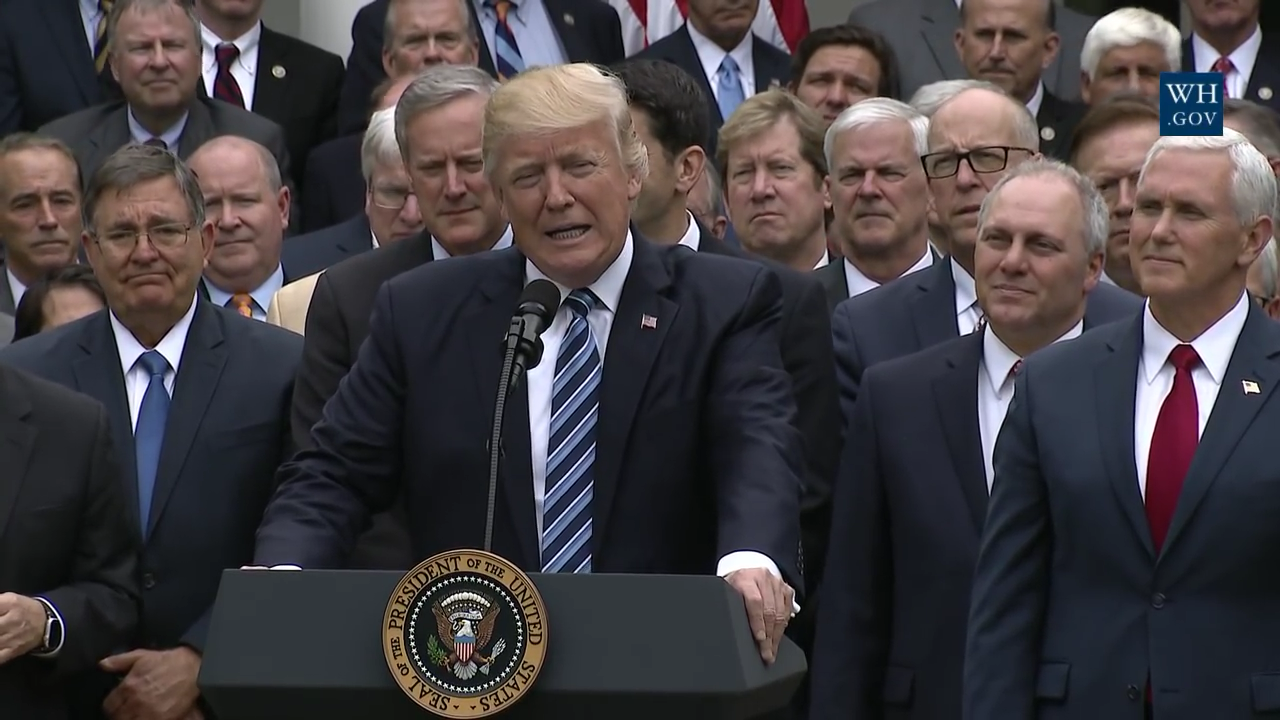

Last month, President Trump and Congressional Republicans delivered a holiday present to the wealthy and large corporations by passing and signing the Tax Cuts and Jobs Act into law, despite its historic unpopularity. As we said before, this tax law will have harmful impacts for women and families.

Last month, President Trump and Congressional Republicans delivered a holiday present to the wealthy and large corporations by passing and signing the Tax Cuts and Jobs Act into law, despite its historic unpopularity. As we said before, this tax law will have harmful impacts for women and families.

While Republicans were rushing to pass this tax scam, many of them started signaling the next step in their “two-step fiscal agenda”: cutting benefits for low and middle-income families in order to pay for said tax cuts for the rich. The most immediate example is looming later tonight: the deadline for funding the government. While Republicans prioritized tax cuts for the wealthy over funding the government for the whole fiscal year, Congress had to punt three times on funding the government for fiscal year 2018, passing three different continuing resolutions (CRs) that maintained last year’s government funding for short periods of time. Congress has also failed to fully extend the Children’s Health Insurance Program (CHIP), which provides health insurance coverage for many children and pregnant women. The third CR expires after midnight tonight, and the latest proposal for a fourth CR passed by the House fails to fully address the immediate unmet needs of women and families: (1) relief from damaging sequester caps for non-defense and defense discretionary programs, (2) CHIP reauthorization, (3) a legislative fix for Dreamers, and (4) disaster relief, and the state of negotiations, though ongoing, is uncertain.

Another manifestation of this two-step agenda: calls for cutting programs benefitting women and families under the guise of “welfare reform” or “entitlement reform.” These efforts are fueled by a false narrative about individuals in public programs that is based on a caricature of an “able-bodied,” single mother of color “collecting” public benefits and willfully refusing to work while living a lavish lifestyle. The reality is that most of us will rely on at least one public program to help support ourselves and our families over the course of our lives. These programs help us make ends meet when we’re struggling to get back on our feet.

The first of these attacks on public programs came last week. The Centers for Medicare and Medicaid Services (CMS) issued guidance that opened the door for states to impose work requirements for Medicaid coverage through waivers. CMS then approved Kentucky’s waiver that included work requirements—the first of its kind for Medicaid—which could lead to 95,000 people in Kentucky losing coverage and will especially harm women and families in Kentucky who received coverage through Medicaid expansion. Women make up the majority of adults covered by Medicaid—over 17 million nationwide in 2016 according to NWLC estimates—with over 360,000 women in Kentucky in the program. The reality is that most individuals covered by Medicaid who can work, do work. Most nonelderly, adult Medicaid enrollees already work, and those who are not working face significant obstacles to working such as illness, disability, or caring for children or sick family members. Taking away someone’s health care will not help them find long-term work faster or move them out of poverty.

Although these attacks on vital programs are of immediate concern, we are expecting direct impacts of the tax bill, like the following, through the 2018 tax season:

- The top 20 percent will receive the majority of benefits from the tax cuts.

- About 1 million children and their families will lose the Child Tax Credit (CTC), while millions of other children in low-income families will get nothing (or next to nothing) from the CTC increase.

- We haven’t seen the end of the confusion for many taxpayers, like those who tried to pre-pay their 2018 property tax bills before 2017 ended and those at risk of underwithholding this year because the Internal Revenue Service is rushing its implementation of the new law. These are just some of the many issues that have resulted from a bill rushed through Congress with handwritten amendments in the margins—all to meet a fake, self-imposed deadline.

- Companies that touted giving their employees bonuses, which are far less valuable than wage raises, “as a result of” the tax bill are laying off employees.

- Employers may change commuter benefits they offer to employees.

And there are many more provisions of the tax law that will have harmful impacts for women in the years ahead (such as leaving an estimated 13 million more people without health insurance coverage by 2026 and increasing health insurance premiums by an estimated ten percent). And of course, this tax bill will cost more than $1 trillion over the next decade ($2.2 trillion if Congress makes the temporary individual provisions permanent), and this high cost will continue to fuel attacks on vital programs.

The fight against the tax bill itself and its ongoing impact on critical programs is a fight to prioritize the well-being of everyday women and their families. If the last two weeks are any indication, there will be plenty to fight going forward. We hope you’ll keep fighting with us.