Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

#FightingForFamilies with State Tax Credits

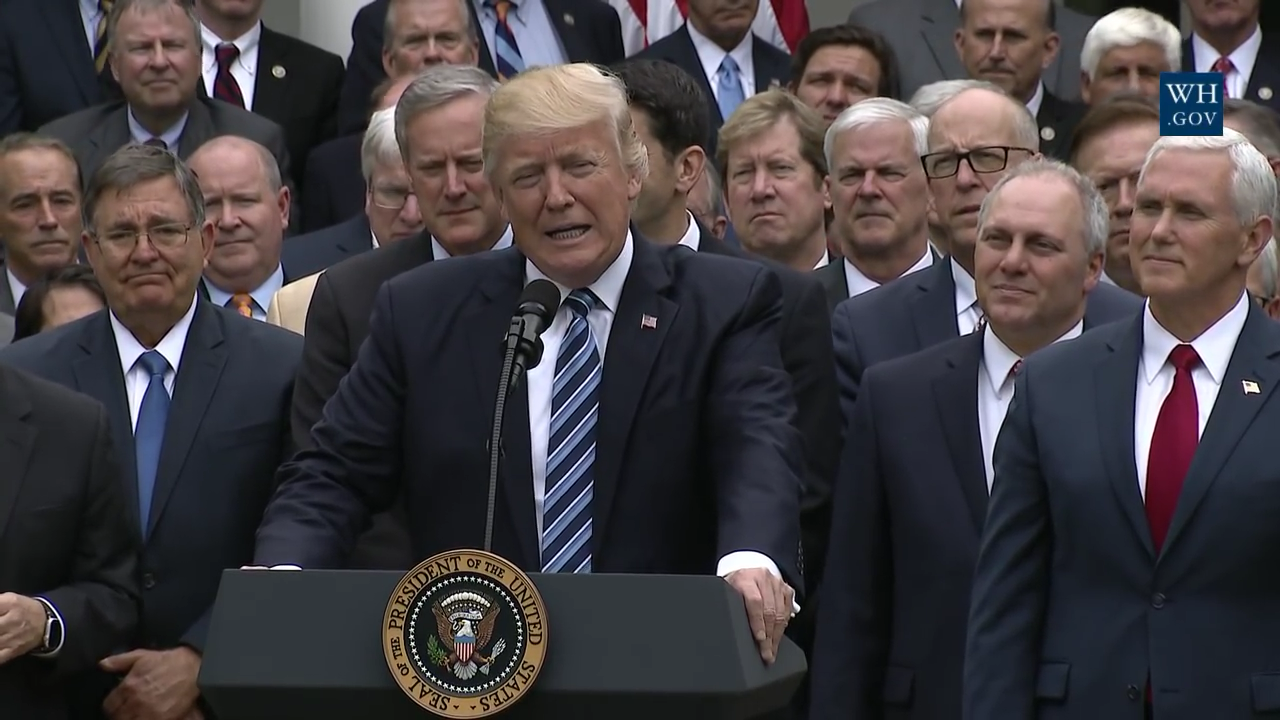

As we’ve said many times, the Tax Cuts and Jobs Act (TCJA) signed into law last December was a bad deal for women. The majority of its benefits go to millionaires, billionaires, and big corporations, and its $1.5 trillion price tag threatens programs and services that are vital for women and families. Despite President Trump’s mythical claim that average family income will increase by more than $4,000 as a result of the tax law, economists and other experts do not see that much of a boost for workers’ paychecks. You may have heard about some companies giving their employees bonuses and/or pay increases. Let’s take a closer look at the facts…

New stories about bonuses or pay increases are mere publicity stunts. Only two percent of Americans have reported receiving a bonus or pay increase because of the tax law, and the companies touting these benefit increases for employees attempt to hide their news about firing workers. Most companies do not plan to use their tax breaks to help workers—wealthy shareholders are the real beneficiaries.

Despite the fact that Republican lawmakers decided to prioritize tax cuts for big corporations and the wealthy in the TCJA instead of improving family tax credits in ways that target lower-income families, states can help the millions of families living paycheck-to-paycheck by creating or expanding state tax credits. While increasing the minimum wage and direct investments in child care, education, food stamps, health care, and other vital programs provide the most support for these families, state tax credits – like the federal ones — can reduce the tax burden some of these families face and, in some instances, provide a refund to families. This helps lift millions of families out of poverty. For example, the refundable federal Earned Income Tax Credit (EITC) lifted almost 5 million people out of poverty in 2015, including more than 1.4 million women and more than 2.7 million children.

State EITCs, Child and Dependent Care (CADC) tax provisions, and Child Tax Credits (CTCs) build on analogous federal family tax credits and help alleviate the unfairness in regressive state tax codes (that is, when low- and middle-income families pay a greater share of their income in taxes than wealthy families).

State tax credits, especially those that provide a refund to families who do not have any tax liability, can lift more families out of poverty. For example, a study of data from 2010-2014 found that Washington, D.C.’s refundable EITC provided an average EITC benefit of $965 and decreased its poverty rates by 0.5 percentage points. As we continue #FightingForFamilies, let’s take time to celebrate that the majority of states offer their own EITC.

Yet many states do not have a credit and can reduce poverty in their states by enacting one. A proposal in Georgia to create a Georgia Work Credit valued at 10 percent of the federal EITC could decrease poverty in Georgia by 0.2 percentage points. If the proposal were more generous and provided a 30 percent match of the federal EITC, then it could decrease its poverty by 0.7 percentage points. The 10 percent match in the Georgia Work Credit proposal would not elevate as many families out of poverty, but it would still provide a meaningful tax cut to over a million Georgia families. In addition, the states that offer a non-refundable credit could make their credit refundable, providing benefits to low-income families who do not have tax liability.

CADC tax provisions can provide help to many families struggling to pay for the child care they need to work, while supporting their children’s healthy development. While direct child care assistance through the Child Care and Development Block Grant provides the most support for families living paycheck-to-paycheck, CADC tax provisions can reduce the amount of tax families owe and, in some instances, provide or increase tax refunds. More than half of states offer some type of CADC provision. And, twelve states have made their credits refundable, unlike the federal credit.

And lastly, very few states have a state CTC. But let’s celebrate New York’s refundable Empire State Child Credit. While it could be improved by expanding it to cover families with children under the age of four, it provided an average credit of $439 to more than 1.47 million families in Tax Year 2015.

While the latest federal tax changes favor the wealthy, states have an opportunity in their legislative sessions to continue their work #FightingForFamilies by creating or improving their state tax credits.