Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

Tips from the Hotline: Help! What is Guaranteed under the Affordable Care Act’s Birth Control Benefit?

Every day on the CoverHer hotline, I hear from people who are trying to take advantage of the Affordable Care Act’s birth control benefit and get the care they deserve. Even though every insurance plan is different, preventive services, including birth control, should be covered without out-of-pocket costs if the Affordable Care Act applies to your plan.

Navigating your insurance plan can be confusing, and the CoverHer hotline is here to break some of the basics down for you!

Is it true that I have to meet my deductible first before getting birth control cost free?

Absolutely not! You should be able to get your preferred method of birth control at no out-of-pocket costs, without having to meet your deductible. In fact, the Affordable Care Act defines out-of-pocket costs to include “deductibles, coinsurance, copayments, or similar charges.” This means that under the birth control benefit, plans must cover birth control without charging a copayment or coinsurance, even if you haven’t met your deductible. So, as long as your plan falls under the Affordable Care Act, your deductible can’t stop you from birth control (and other preventive services) at no cost.

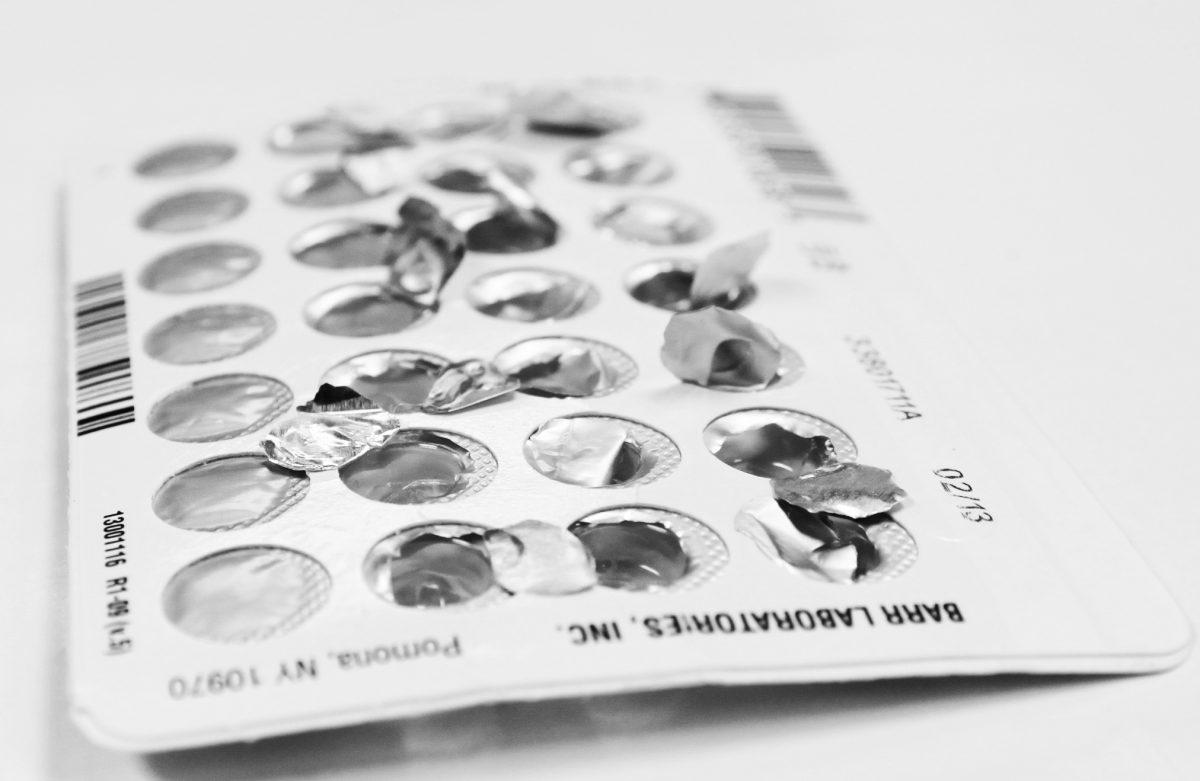

Are all methods of birth control are covered under the birth control benefit?

Yes! The Affordable Care Act requires coverage of the full range of Food and Drug Administration (FDA) approved birth control methods for women. Specifically, there are 18 methods covered under the birth control benefit:

The Department of Health and Human Services has published guidance requiring that insurance plans must cover the above 18 FDA approved methods with no cost to women. It is important to note that your insurance plan must cover at least 1 type of method for each category. Your insurance company doesn’t have to cover every birth control pill on the market, but, for example, it does have to cover the Nuvaring because it is the only type in its category. It’s important to always double check if your preferred pill or IUD is covered by your insurance plan to avoid paying out-of-pocket. If your preferred method is not covered by your insurance company or has cost-sharing attached, you should ask your health care provider about a medical necessity waiver. If a provider recommends a specific option or product, plans must cover it without cost-sharing and the waiver process should get you that coverage.

I want an IUD, but does my insurance cover the insertion and removal?

Of course they should! Your coverage must also include the clinical services needed for the birth control method of your choice. Your plan is required to cover the birth control method AND related services without out of pocket costs. This means your IUD must be covered, and also the counseling with your health care provider, ultrasound, insertion, and removal. If you have incurred any bills for related IUD services, make sure your doctor has used the right billing code to ensure your office visits were coded and modified correctly to reflect the birth control related visit. It is also important to make sure your preferred brand of IUD is covered under your plan BEFORE your IUD appointment.

If I work for an employer who objects to birth control, does that mean I have to pay for my birth control?

The answer is… it depends! Some entities, like churches and other houses of worship, do not have to cover birth control or counseling. Except for limited situations, people who work for employers with objections to birth control should still be getting seamless birth control coverage. While the Trump Administration created new rules, allowing virtually any employer with religious or moral objections to refuse to cover birth control, courts have temporarily blocked those rules from taking effect.

If you think your employer is trying to take advantage of the Trump rules or your employer isn’t covering your birth control as it should, please contact CoverHer to get assistance in understanding your benefits!

Do I have to pay out-of-pocket for my well-woman visit?

Nope! Thanks to the Affordable Care Act, you have coverage for well-woman visits, without additional costs like co-pays or deductibles. A well-woman visit is a check up to make sure you are in good health and up-to-date on all your health screenings. A well-woman visit doesn’t only include your annual exam, but all preventive care services for women like: breast cancer screenings, HPV screenings, and birth control counseling. It’s important to take advantage of well woman visits to discuss any health concerns with your provider and learn about preventive services you may need to stay healthy.

If you have more questions about the birth control benefit or you are paying out-of-pocket for birth control please contact us at www.coverher.org, [email protected], or 1-866-745-5487.