Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

The Most Consequential Supreme Court Case You’ve Never Heard Of

These HORRIBLE decisions made national headlines (as they should have). But on December 5, 2023, the Supreme Court will hear a case that could potentially devastate women’s economic security.

But because the case is about taxes, barely any news outlets are talking about it.

Preview of the Case

Moore v. United States is a case being brought by Charles and Kathleen Moore, who are challenging the constitutionality of a one-time tax that they had to pay on the profits of their investments in a foreign company.

If the Moores win, it could call into question not just the specific tax they paid, but also other, longstanding provisions of the tax code, which could lead to the loss of billions or even trillions in federal revenue.

To make matters worse, Charles and Kathleen, and the deep pockets supporting them, have gone even further by asking the Supreme Court to look beyond this specific tax and rule on whether future legislative efforts to tax billionaires’ wealth are unconstitutional.

To be clear, the Supreme Court is not supposed to rule on future, hypothetical laws. But what’s more, ruling in the Moores’ favor has the potential to limit Congress’ ability to raise money for big, bold investments in women and families — things like universal child care or aging and disability care — by taxing billionaires.

Why Blocking These Future Tax Laws Is a Problem

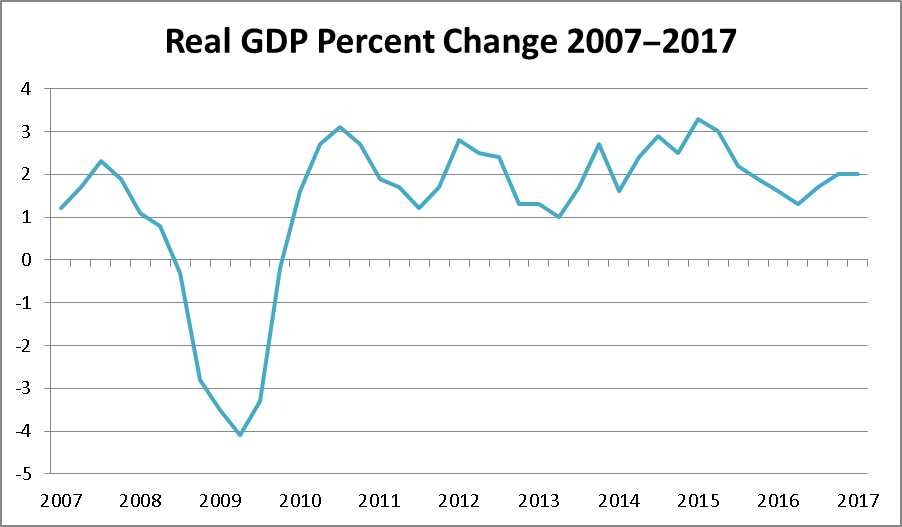

For years, an army of corporate lobbyists has been arguing that the only way to grow the economy is to lower taxes for the ultra-rich. It’s trickledown economics at its finest, and the fact that 50 years of evidence shows that it doesn’t work hasn’t stopped them.

As a result of their greed, tax rates for the wealthiest and big corporations are at historic lows. This means that the federal government is collecting fewer tax dollars — fueling budget shortfalls. Some policymakers are more than happy to point to those shortfalls as an excuse to why they underfund priorities that are important to women and families.

For example, at this very moment, Congressional Republicans are balking at increasing funding for nutrition assistance for pregnant women and infants. So rather than tax billionaires more fairly, Republicans are literally trying to “cut costs” by denying food to babies and mothers.

What Women Lose if the Moores Win

The whole reason we have a tax code in the first place is to pool our shared resources so that we can invest in our shared priorities.

Congress has the power to shape the tax code to reflect economic realities and our values as a nation – and use the tax dollars it raises to improve people’s lives and make the economy work for us all. A Supreme Court ruling that sows doubt about huge portions of the existing tax code would be an immense overreach, even more so if the Justices take the invitation to block future taxes on billionaires.

If that happens, we will lose a critical mechanism for raising more tax revenue, making it even harder to persuade policymakers to invest in universal child care, affordable housing, paid leave, aging and disability care, and more.

In Conclusion

The decision that our Supreme Court makes in Moore v. United States could have enormous consequences for women and families. It has the potential to undermine both the way the federal government collects revenues now, as well as future efforts to raise more tax revenues by making billionaires pay their fair share.

The Court should follow the law, the facts before it, and decades of precedent to uphold the law, and Congress should use its power to advance gender and racial justice through the tax code, thereby raising the revenue needed to invest in women, families and all of us.

For more information on this case, you can read my op-ed that was recently published in Ms. Magazine.