Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

The House GOP Tax Plan Is A Raw Deal for Women and Families

Last week, Republicans in the House introduced the “Tax Cuts and Jobs Act,” which would raise taxes on vulnerable women and families while giving new tax cuts to the wealthy and big corporations. This tax plan comes on the heels of a backwards budget passed by Republican Members of Congress that enabled tax cuts for the wealthy and big corporations while slashing investments in women and families. Together, these two measures are a double-whammy for working families.

The details of the House tax bill show that numerous families will lose important tax benefits while the super-rich would receive new tax cuts that they do not need. Families would then end up paying for those tax cuts through trillions of dollars in cuts to vital programs such as Medicare, Medicaid, child care, public education, and job training. This backwards tax plan is the last thing women and families need when rising inequality has already undermined the economic security of millions.

The GOP tax plan gives crumbs to everyday women and families that shrink over time and will raise taxes on many of those families over the next decade.

While House Republicans have sold their tax plan as helping the middle class, a closer look reveals that many vulnerable middle-class and lower-income families would lose out under the plan. Overall, the plan eliminates tax benefits that are essential to vulnerable families—families that may need to incur debt to pursue the dream of higher education, families that may have members with serious, costly medical conditions, and more—while actually increasing the taxes that working families owe over time. The plan also fails to help families meet the high costs of child care.

- The GOP tax plan proposes eliminating a dramatic amount of deductions that are critical to working families. For example, eliminating the deduction for state and local income and sales taxes would be a hard hit for families in states like New Jersey, Maryland, and Virginia with high state income taxes. Eliminating the student loan interest deduction would reduce the economic security of recent graduates, especially black women, who have the highest mean cumulative debt after college. Furthermore, the plan would raise taxes on families that have serious, costly medical conditions by eliminating the medical expenses deduction. Also on the chopping block are tax benefits for parents adopting children and for alimony payments. Thus, no matter the pitch used to sell this plan, there’s no disguising who would be hurt the most.

- The GOP tax plan eliminates the personal exemption taxpayers can claim for themselves and each dependent. The GOP claims that their tax plan “doubles” the standard deduction by raising it from its 2018 value under current law of $13,000 for a married couple to $24,400. But this increase cannot be viewed in isolation—it’s paired with the elimination of personal exemptions (valued for 2018 at $4,150 for the taxpayer and each dependent) that taxpayers can currently claim no matter whether they use the standard deduction or itemize their deductions. Eliminating personal exemptions will translate into tax increases for many families, especially those with children.

- The GOP tax plan’s supposed benefit for working families – the Child Tax Credit – leaves out those who need help the most. While the GOP tax plan provides for a nonrefundable $600 Child Tax Credit increase, more than 10 million children in low-income families – those who struggle the most to make ends meet – would be excluded from this increase. Instead, the Republicans’ Child Tax Proposal makes more six-figure families eligible to claim the credit. At the same time, a harmful provision in the bill would take the Child Tax Credit away from 3 million low-income children whose parents file their taxes with an Individual Tax Identification Number (ITIN).

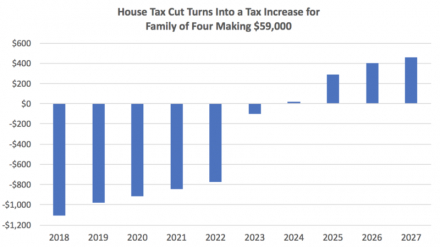

- The amount of benefits that are in the bill for working families actually decrease over time and in later years, many working families will actually have to pay more in taxes. First, although the bill creates a new tax credit for of $300 for each non-child dependent (spouse and other adults living in the household), the credit would actually expire after 5 years. (In contrast, the business tax cuts are permanent.) Additionally, the value of working family tax credits (including the Child Tax Credit) are indexed using the chained CPI—a measure of inflation that is slower than the traditional measure of inflation, meaning that the value of the tax credits for working families goes down over time. By 2027, almost 20 percent of households will face a tax increase. Professor David Kamin at NYU Law School ran the calculation for the family of four example House Republicans are using and found that the initial tax cut from the House GOP plan would turn into a tax increase over the next decade:

- The GOP tax plan fails to address the rising costs of child care, which hamper economic security for millions of women and their families. In addition to the numerous deductions described above, the GOP tax plan proposes eliminating, starting in 2023, the exclusion of dependent care flexible spending plans some employers offer to their employees to help with the high cost of child care. This provision benefited almost 4 million families in 2016.

The GOP tax plan gives the largest benefits to the top 1%, and those benefits grow over the next decade.

While vulnerable women and families are getting the short-end of the stick, the wealthiest among us and big corporations would receive large, permanent, and costly tax cuts. The Institute on Taxation and Economic Policy (ITEP) recently released its analysis of the GOP tax plan, based on the most recent distributional analysis by the Joint Committee on Taxation, and found that the richest 1% of taxpayers would receive the largest tax cuts in terms of average tax cut dollars ($48,580 in 2018 and $64,720 in 2027) and percent of income (see chart below).

Here’s a glimpse of how the GOP tax plan cuts taxes for the wealthiest corporations and individuals among us:

- The GOP tax plan proposes cutting taxes for wealthy corporations. While some politicians make hay about the high statutory corporate tax rate, the fact is that corporations currently pay an average effective rate of only 24 percent, and many corporations pay little or no taxes. Yet the latest tax bill maintains the proposal from the Unified Framework to slash the top statutory tax rate for corporations from 35 percent to 20 percent.

- The GOP tax plan gives tax breaks to those inheriting more than $5 million. The plan proposes doubling the current exemption of $5 million from the estate tax to $11 million per person ($22 million per couple). Wealthier estates that would still pay the estate tax would get a tax cut of about $4.4 million per estate—enough to give 1,100 Pell Grants to help students afford college. The GOP tax plan then goes one step further and proposes repealing the estate tax altogether in 2024.

This backwards GOP tax plan will lead to trillions in cuts to vital programs and services helping women and families.

The GOP tax plan will increase the deficit by $1.5 trillion—that’s a cost that will be paid for later through cuts to critical programs helping women and families. That’s not a random prediction—that’s based on long-range budgets. Several House Budget Committee members even said they wanted to cut taxes this year and prioritize mandatory spending cuts next year. And we have a roadmap of what those cuts would look like from the Republican budgets. The Trump budget proposed earlier this year included cruel cuts to vital programs for women and families. The 2018 budget plan Congress passed proposed $5.8 trillion in cuts over the next decade, including $1.8 trillion in cuts to Medicaid, Medicare, and other health care programs; education, housing, food assistance, and other key investments. These programs are especially essential to low-income women and their families and cuts to these programs would hurt the economic security of women and families.

This GOP tax plan is a bad deal for women and families. They get crumbs and will be asked to foot the bill for large tax cuts for millionaires, billionaires, and corporations. As we’ve said before, “They deserve better.”