Some Senators Want to Lay the Groundwork for a National Abortion Ban in Our Tax Code. Don’t Fall for It.

The thing about anti-abortion lawmakers, they never pass up an opportunity to attack abortion. Even as the lights have gone out at abortion clinics across the country and pregnant people are harmfully being refused care – even dying – due to draconian state bans on abortion, the extremists aren’t done attacking abortion rights. And they won’t stop until abortion is illegal for everyone nationwide.

Now, there are a few ways anti-abortion extremists could try to shut down abortion nationwide. One would be for Congress to pass a national ban that the president signs. The second is that president – without any legislative action – could manipulate a dormant “anti-vice” Victorian-era law passed in 1873, i.e. 150 years ago (back when women didn’t have the right to vote, so you can guess how that ends) to basically shut down almost all abortion care nationwide. Third, the Supreme Court could decide that fetuses and embryos are persons under the U.S. Constitution – meaning they would get protections under the Fourteenth Amendment that would override any state law abortion protections for the pregnant person.

It’s this third effort – the so-called “personhood” effort – that got a boost in late September. You may have heard about “personhood” back in February, when a Supreme Court of Alabama ruling recognizing personhood protections for frozen embryos basically shut down fertility care in that state. Now, I know you’re wondering, what is personhood really? I’m glad you asked.

“Fetal personhood” is a four-step anti-abortion strategy.

Step one: insert rights for fetuses throughout our federal and state laws.

Step two: argue in court that these separate rights for fetuses means that they are individuals separate from the pregnant person.

Step three: push the Supreme Court to conclude that, you know what, since fetuses are separate from the pregnant person, they should get the same rights under the U.S. Constitution as people.

Which then brings us to step four: ask the Supreme Court to rule that no state could protect a pregnant person’s right to abortion because the fetus’ federal constitutional rights would trump a pregnant person’s right to an abortion. (And step four would also mean the government could protect a fetus’s rights through invasive and oppressive control over anyone who could potentially become pregnant —which would reach beyond abortion, to include fertility and contraceptive care, medical research, and criminalization for behavior during pregnancy, to name just a few destabilizing and dangerous consequences.)

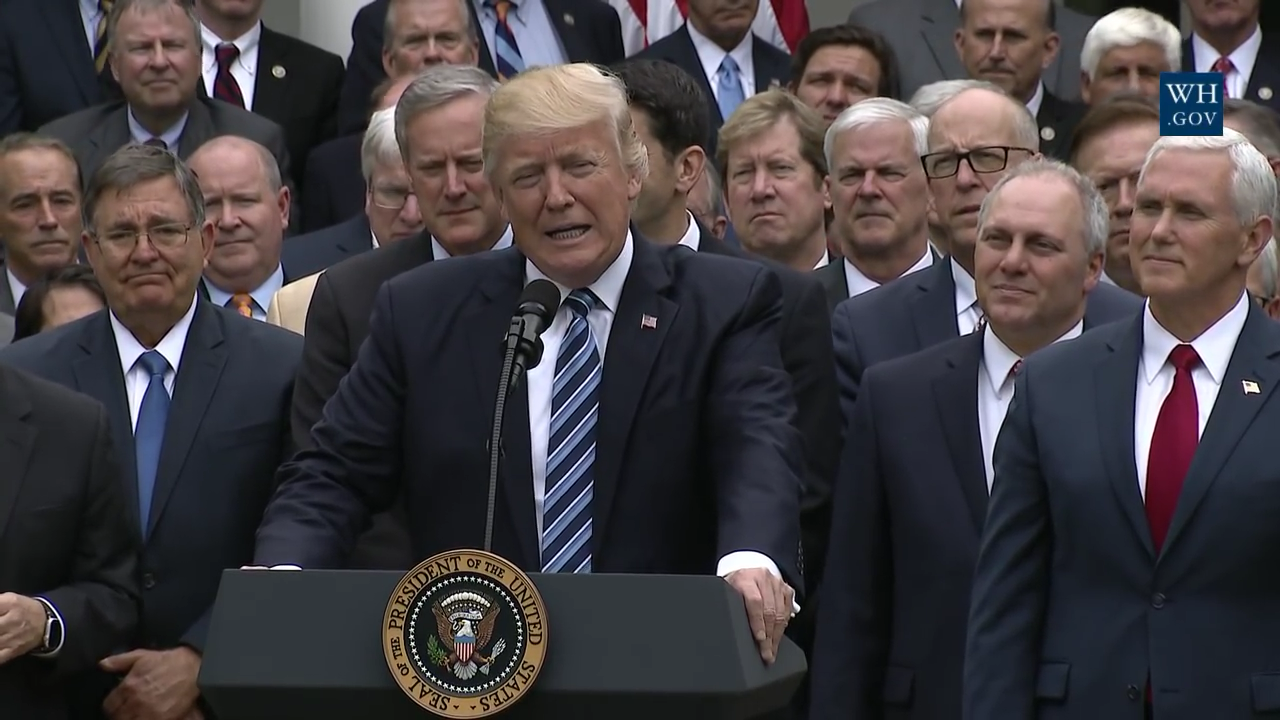

So, what personhood thing happened late September, you ask? Well, on September 26, Senator Romney introduced the Family Security Act, which, for the first time, would allow a taxpayer to claim an “unborn child” for a tax credit. Now, you may be thinking, isn’t that a good thing?

Typically, the National Women’s Law Center has fought hard for expanded economic benefits that support women and families. We strongly advocate for tax credits that benefit families, including an expanded, fully refundable Child Tax Credit (CTC), which helped cut child poverty in half and helped millions of families make ends meet in 2021.

However, the first goal of Romney’s bill is not about helping pregnant people, it’s about advancing anti-abortion building blocks to personhood. It’s no coincidence that the organizations endorsing the bill are prominent anti-abortion organizations.

So how does it fall short of actually helping women and families? Besides seeking to codify personhood in tax law, it requires the pregnant person to share information about their pregnancy that could then be later weaponized against them if they experience a negative pregnancy outcome. It also denies the credit to a pregnant person with an ITIN (a tax processing number for an individual without a Social Security number), which doubles down on existing ITIN restrictions and would prevent many immigrant families from benefiting. What’s more, the bill would fund the new tax credit by cutting other much-needed benefits for families with low and moderate incomes—including by repealing the head of household filing status, which would especially hurt single mothers. See what we mean about not really advancing the needs for women and families?

The National Women’s Law Center advocates for abortion access because we believe individuals should be able to make decisions about what’s best for themselves and their families. In the same vein, we advocate for lawmakers to expand the Child Tax Credit, and other supports—like health care, nutrition and housing assistance, child care, paid family and medical leave, and more. Because again, we believe in giving individuals the support they need to thrive and live with dignity, so they can decide for themselves what’s best for their particular circumstances.

We all want what’s best for ourselves and our families. That means having the freedom to decide if and when we grow our family, how we define family, and how we care for our loved ones. So, long story short? Romney’s bill isn’t it.