Make your tax-deductible gift by December 31—every gift matched, up to $150,000!

In this moment, the future of our rights, our bodily autonomy, our freedom feels uncertain. What we do next will make a difference for decades to come.

Make your tax-deductible gift by December 31—every gift matched, up to $150,000!

In this moment, the future of our rights, our bodily autonomy, our freedom feels uncertain. What we do next will make a difference for decades to come.

Double your impact in the fight to defend and restore abortion rights and access, preserve access to affordable child care, secure equality in the workplace and in schools, and so much more. Make your matched year-end gift right now.

“Raising a child is hard work.”

I doubt there is anyone in the U.S. who hasn’t heard this phrase at least once or twice—especially from their parents. And on the whole, as a society, I’d say we tend to believe that’s true.

But perhaps Trump’s nominee for White House Budget Director would argue that hard work suddenly disappears when someone else is raising your children for you. Earlier today at his nomination hearing for Director of the Office of Management and Budget, Mick Mulvaney explained that he failed to pay the $15,000 owed in taxes for his children’s nanny because he thought of her as a “babysitter” as opposed to a household employee. He explained, “She did not live with us. She did not spend the night there. She did not cook. She did not clean. She did not educate the children, she helped my wife with the children”—and was thus not a household employee for whom he should pay taxes.

It is important, firstly, to note that according to the IRS, babysitters are in fact considered household employees. So, no matter what—the White House Budget Director nominee’s argument had a certain hole in it.

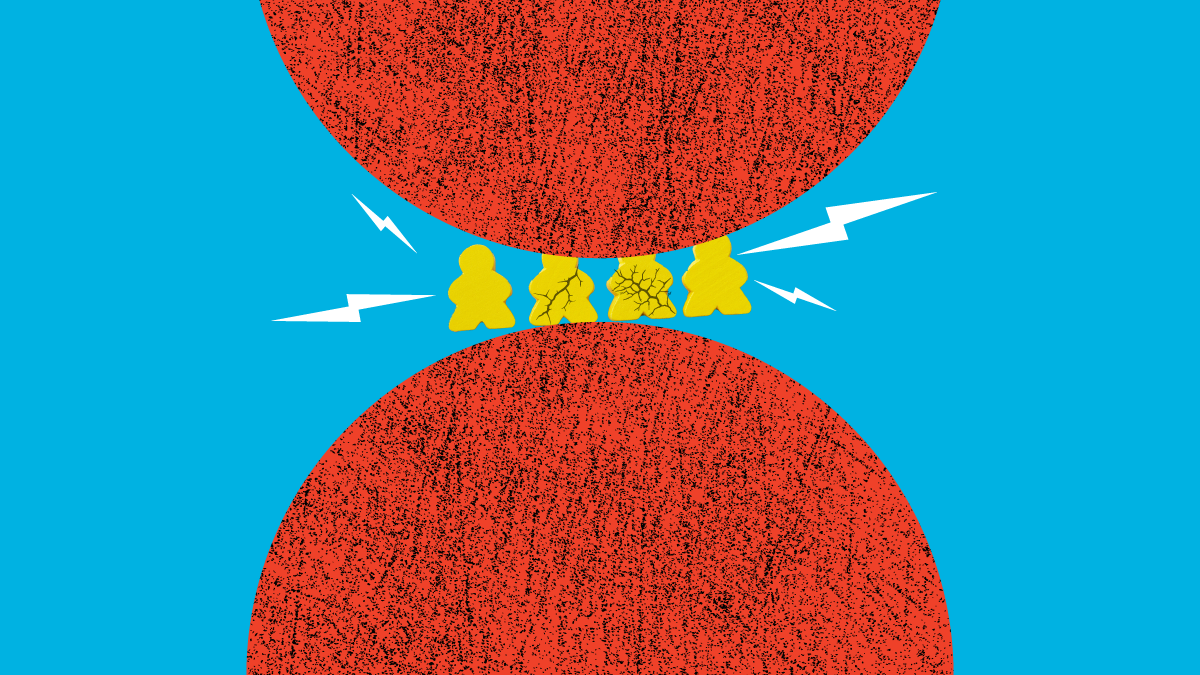

But beyond that, chances are if it’s hard work to raise a child yourself, it’s also going to be hard work to raise that same child for someone else—or to “assist” someone in raising a child. Mulvaney is not just devaluing the hard work of his nanny who worked over 40 hours a week in helping raise his newborn triplets, he is devaluing the hard work of all child care providers—nannies, child care teachers, moms, and dads alike. Though when asked by Senator Peters (D-MI), he said he did not value her work less than his other employees—he owned a real estate business at the time—he clearly stated that there was a “differentiation in [his] mind” between someone who cared for the children and one of his employees at his business.

During the early years of their lives, children develop at an incredibly fast rate. Scientists know that it’s not just biology that impacts their development, but also their experiences. As the Center on the Developing Child notes, children need reliable and appropriate responses to their attempts to connect with the world through babbling, gestures, and facial expressions. Without a well-informed care provider with whom to interact, children’s brains won’t properly grow and develop.

Additionally, quality child care providers help children develop emotionally and socially; they give children the foundation upon which to build healthy lives. Child care is an incredibly valuable service for children, especially during the early years of a child’s life. To regard it as something less than work is to undervalue the brain of a healthy child.

Child care is work, and it certainly requires a great deal of skill. To say that a nanny—or a “babysitter”—is not a household employee is not only reflects a gross misunderstanding of the tax code, but also devalues the hard work that goes into the care of our youngest children —by nanny, teacher, mom, or dad alike—and ignores the science of early learning.