Abortion rights, women of color, and LGBTQI+ people are under attack. Pledge to join us in fighting for gender justice.

Your Health Insurance Company Is Gaslighting You—and Breaking the Law

If you have ever had trouble getting a health insurance company to… well, cover your health care expenses (imagine!), you probably know what it’s like to be told that your plan doesn’t cover something it is supposed to—and then been completely gaslit when you tried to fight back.

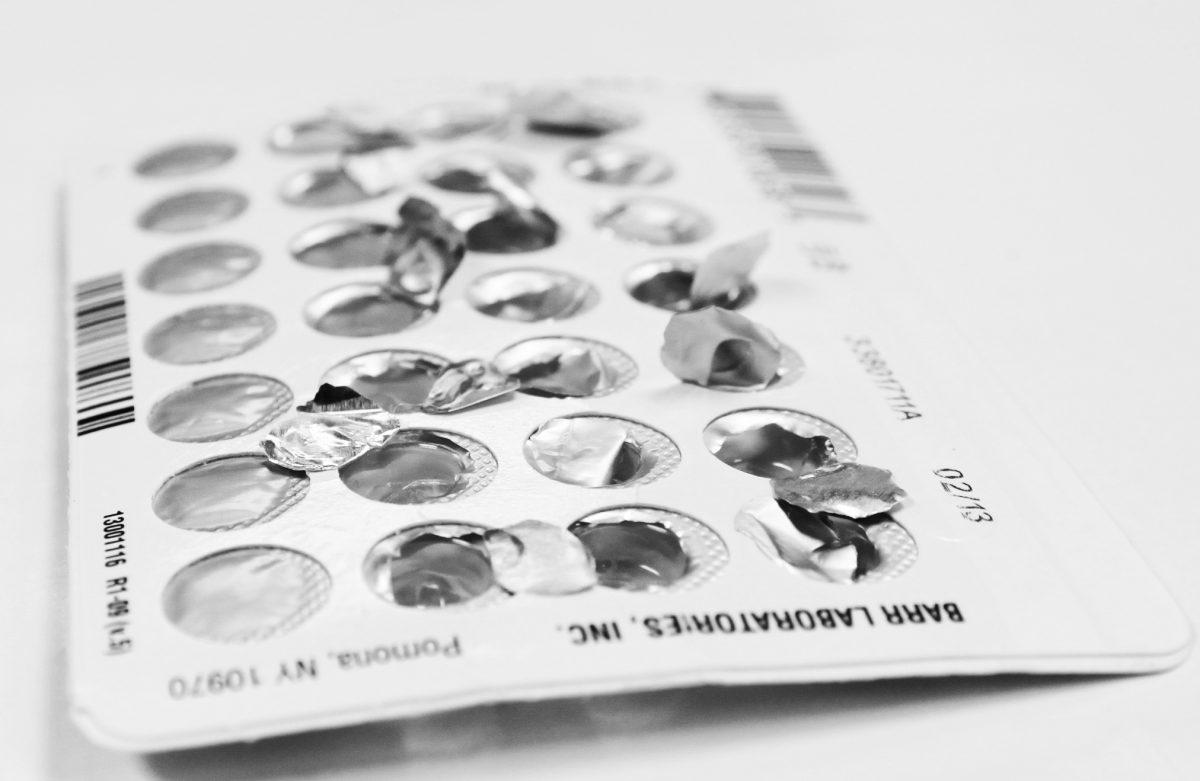

It’s especially frustrating when you can’t get your insurance company to cover your birth control, which we know they’re required to do under the Affordable Care Act (ACA).

Apparently, insurance companies think they can make us doubt what we know is true. Because every week, I hear from people through our CoverHer hotline who tell me that they’re still being charged for birth control, and their insurance companies continue to claim they don’t have to cover it.

So, you can imagine the happy dance I did in my desk chair (there were a lot of fist pumps) when this October, the House Committee on Oversight and Reform issued a new report that validated what we all know is true: Insurance companies impose a ton of barriers to no-cost birth control access, with serious consequences for people’s health and financial well-being—especially people with low incomes and people of color.

Here are my favorite parts of the report, and why:

- Thirty-four (34!) contraceptive products are excluded from coverage or have cost-sharing requirements imposed by insurance companies—and that’s against the law. The ACA is clear: Insurance companies must cover contraception without cost-sharing, especially when a product does not have a generic equivalent. And yet, as we know from CoverHer, and as confirmed by this report, insurance companies are blatantly violating this rule, refusing to cover products like Slynd (a progestin-only pill), Lo Loestrin Fe (a low-dose estrogen pill), Phexxi (a non-hormonal vaginal gel), and the Annovera ring (a vaginal ring that lasts a full year).

- Insurance companies are preventing people from getting the birth control that works best for them. The ACA doesn’t require plans to cover every single birth control product, but if a doctor determines that a particular product is medically appropriate for a patient, their insurance plan must defer to the provider and provide no-cost coverage. To do this, plans are supposed to have an easy and accessible waiver or exceptions process in place. All the insurance companies that this Committee investigated claimed to have these procedures, but the report found that insurance plans’ “waiver processes” are not quick or simple enough, nor are they deferring to providers. Insurance companies can skirt the law and the truth, but the numbers don’t lie—an average of 40% of exceptions requests are denied.

- The thing I was most impressed by? This report’s effort to acknowledge the disproportionate impact these barriers have on people of color and those with less income. As pointed out in their analysis, a lot of low- or no-hormone birth control options are necessary alternatives when a patient can’t use higher-dose estrogen pills due to health reasons, and Black women are more likely to experience those health conditions. The report also made it clear that those who have less income are disproportionately affected by these barriers too—not only for the obvious reason that the cost poses a greater impediment, but also because insurance plans are more likely to exclude products that are used by people with low incomes.

By denying people their right to contraceptives without cost-sharing, insurance companies violate the law and make it our job to correct them, forcing us to use our time, resources, and energy to get something that is already our right to begin with. That injustice can only be addressed when insurance companies are held accountable and begin complying with the law.

This report is a huge step in the right direction—but there’s more work ahead. And what we really need is stronger enforcement of the ACA preventive services provision.

Because access to contraception matters. With the Supreme Court’s decision to overturn Roe v. Wade and threats to contraception no longer a hypothetical, it’s more important than ever that people are able to take control of their reproductive lives through their preferred method of birth control—and gaslighting insurance companies should not be blocking their way.