Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

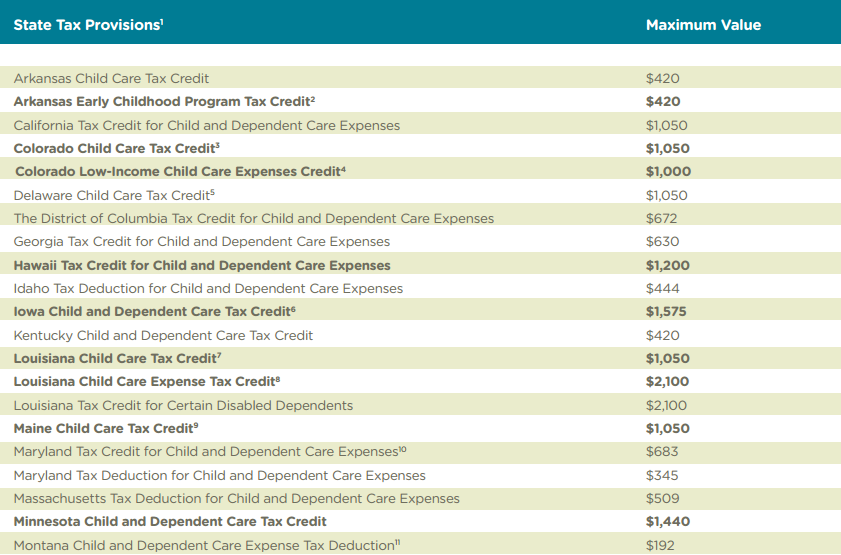

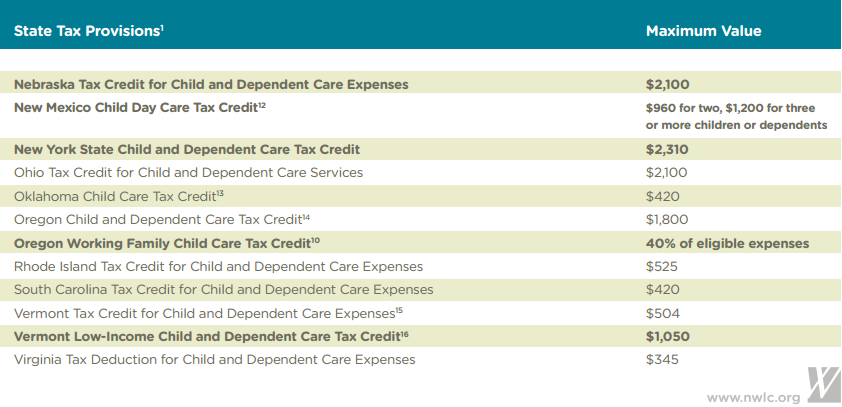

Tax Provisions, Tax Year 2015

Child and dependent care expenses can take a huge bite out of families’ budgets. With few increases in state or federal funding, direct child care assistance is not available to every family that needs help paying for child and dependent care.

The federal Child and Dependent Care Tax Credit and similar state tax provisions can help eligible families offset their child care expenses. These tax provisions can lower the income taxes that families must pay and, in some cases, give cash refunds to families whose incomes are too low to owe taxes.

Twenty-six states (including the District of Columbia) have child and dependent care tax provisions. Twelve of those states offer refundable credits (listed in bold).

For more information about state child and dependent care tax provisions, see NWLC’s report, Making Care Less Taxing, available at http://www.

nwlc.org/our-resources/reports_toolkits/making-careless-taxing.