Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

NWLC Reacts to Census Bureau’s Data Showing Historic Increase in U.S. Poverty Rate

Washington, DC – Today, the U.S. Census Bureau released new data that revealed an historic increase in the country’s poverty rates.

Between 2021 and 2022, the poverty rate as measured by the Supplemental Poverty Measure (SPM) increased from 7.8 percent to 12.4 percent for the overall population. This increase is larger for women and girls (from 7.9 percent to 12.8 percent) and for those under the age of 18 (from 5.2 percent to 12.4 percent) — marking the country’s largest ever recorded single-year increase in SPM poverty in more than 50 years.

Melissa Boteach, Vice President of Income Security at the National Women’s Law Center (NWLC) released a statement on the data’s findings:

“This data once again highlights that poverty in our country isn’t a personal failing, but rather a policy choice. Lawmakers have the power to lift millions of women and children out of poverty if they would just choose to prioritize families over their wealthy donors.

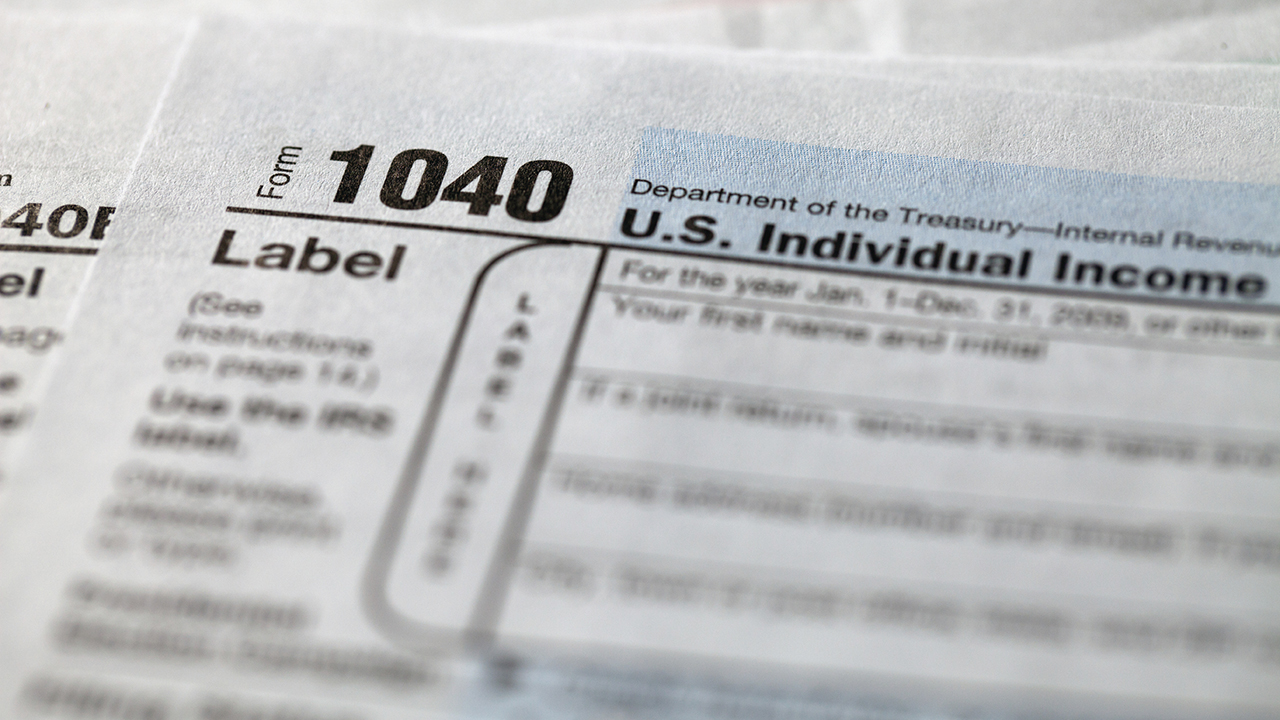

“We know what works. The expansion of the child tax credit in 2021 led to the most significant decrease in poverty on record. Rather than double down on that proven success, lawmakers allowed the program to expire, taking away income that families were relying on for groceries, rent, child care, and more. Congress must act to reinstate the improvements to the child tax credit, invest in child care, and take other steps to ensure that women – and the families who rely on us – have the supports we need to thrive.”

Women — especially Black, Latina, and Native women, women with disabilities, and immigrant women — and LGBTQ+ individuals have long been disproportionately likely to experience poverty and hardship. NWLC’s research reveals how public policy impacts these populations and points to practical solutions to address these inequalities:

- NWLC, in partnership with the Center for the Study of Social Policy, recently released a survey on the expiration of the expanded child tax credit, which found that after the expanded tax credit expired, families had a harder time affording essentials like bills and food.

- In 2022, NWLC released a report outlining how the expansion of refundable federal income tax credits, such as the Earned Income Tax Credit and the child tax credit, helped reduce racial, gender, and economic inequities.

- Earlier this year, NWLC released an issue brief highlighting how key anti-poverty programs, such as housing assistance, refundable tax credits, nutrition programs, and unemployment insurance can help lift women and nonbinary individuals out of poverty.