All gifts, up to $10,000, TRIPLE-matched until June 30!

It’s Not Really About Work

One of the important components of the American Rescue Plan is the temporary expansion of refundable tax credits like the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). Expanding refundable tax credits is a targeted, effective form of relief that will help women and families weather the recession. Even outside of a recession, families spend their tax refunds to pay bills, reduce debt, and make purchases that they otherwise couldn’t. And it is a pretty safe bet that people with low incomes will do the same during a pandemic (both helping them pay for necessities, and pumping funds back into the economy).

One of the important components of the American Rescue Plan is the temporary expansion of refundable tax credits like the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). Expanding refundable tax credits is a targeted, effective form of relief that will help women and families weather the recession. Even outside of a recession, families spend their tax refunds to pay bills, reduce debt, and make purchases that they otherwise couldn’t. And it is a pretty safe bet that people with low incomes will do the same during a pandemic (both helping them pay for necessities, and pumping funds back into the economy).

Last week, the House Ways and Means Committee approved legislation that would, among other things, temporarily expand the CTC, make it more valuable for younger children, and make it fully refundable. This last element of the CTC proposal is especially important: under current law, households must have at least $2,500 in earnings to receive a refund from the CTC. An estimated 27 million children, who are disproportionately Black and Latinx, currently receive less than the full CTC because their parents earn too little. Expanding the CTC as the American Rescue Plan proposes is estimated to lift over 4 million children above the poverty line, disproportionately helping Black and Latinx children.

However, some critics are arguing that it’s a bad idea to allow families with little or no earned income to receive the CTC, out of a misplaced concern that it would disincentivize parents from working. Some are handwringing that eliminating the earned income requirement from the CTC would effectively reinstate “welfare.” Similarly, Senator Mitt Romney recently introduced a proposal for a child allowance that offsets the cost of the child allowance by cutting existing income supports (such as TANF, some SNAP benefits, the Child and Dependent Care Tax Credit, and trimming the EITC). The message is clear: for these critics, it is REALLY, REALLY IMPORTANT to not help families with low incomes too much.

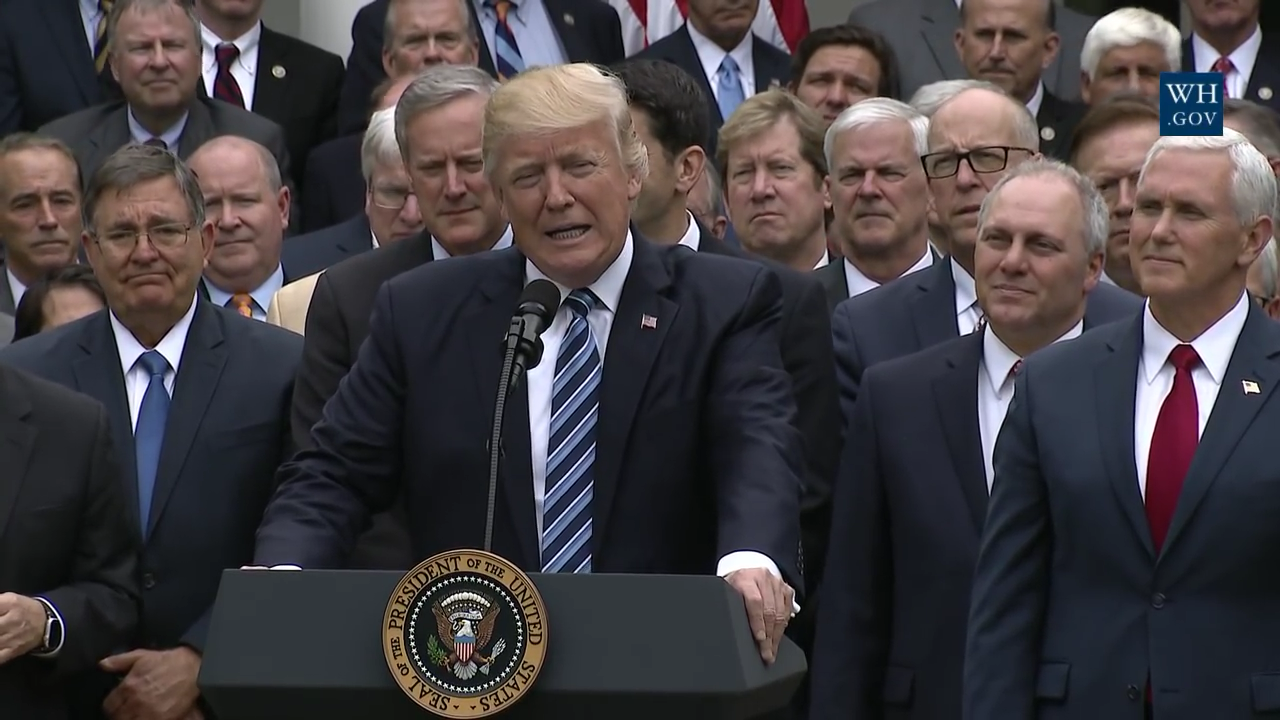

The question is why. Unsurprisingly, there is little evidence that people will decide not to work (or work less) if they receive a larger tax refund. Also no surprise: no one worried about discouraging work when the full $2,000 per child CTC was made available to families with six-figure incomes as part of the 2017 Trump tax cuts. And few of those who are fretting about the impact of refundable tax credits are calling for policies that truly would support low-income working parents, like increasing wages or providing paid leave and affordable, high-quality child care.

Instead, as the scarifying about “welfare” might suggest, this is really about keeping women of color economically desperate. The myth of the welfare queen, and the trope that depriving Black and brown women of basic living standards is necessary to motivate them to work, are just cover for a conscious policy decision to underinvest in our families and communities.

We reject the racist and sexist politics of austerity. It’s a sign that our economy is deeply flawed when someone has to work three jobs to feed their families even before the pandemic hit. If we truly are going to build back better, COVID relief must ameliorate the unprecedented hardship that women of color are experiencing during the pandemic—not double down on the racist and sexist policies that helped create it.