Abortion rights, women of color, and LGBTQI+ people are under attack. Pledge to join us in fighting for gender justice.

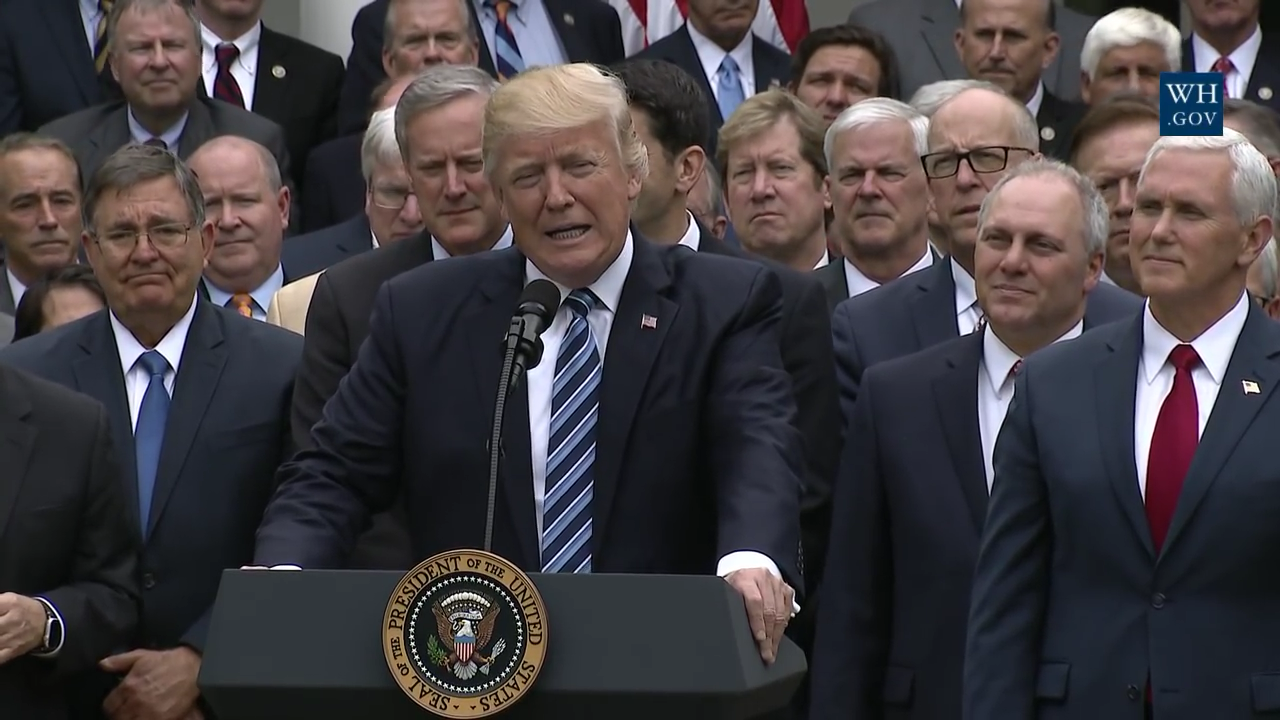

Congress Passes Tax Cuts for Wealthy While Children and Dreamers Hang in the Balance

Today, Congress officially passed the Tax Cuts and Jobs Act and President Trump signed it into law. Despite the bill’s extremely low approval ratings (hovering somewhere around 32%), the GOP rammed it through Congress on a remarkably abbreviated timeline. At its core, this legislation is a huge tax giveaway to millionaires, billionaires, and corporations. Do not be fooled by GOP claims that this is a “middle class tax cut.” The Tax Cuts and Jobs Act will make it harder for many working families to make ends meet.

Today, Congress officially passed the Tax Cuts and Jobs Act and President Trump signed it into law. Despite the bill’s extremely low approval ratings (hovering somewhere around 32%), the GOP rammed it through Congress on a remarkably abbreviated timeline. At its core, this legislation is a huge tax giveaway to millionaires, billionaires, and corporations. Do not be fooled by GOP claims that this is a “middle class tax cut.” The Tax Cuts and Jobs Act will make it harder for many working families to make ends meet.

Here are some top lines from the final bill:

- It repeals the Affordable Care Act individual mandate, which will lead to an estimated 13 million more uninsured Americans.

- It eliminates tax deductions for some work-related expenses, making it more expensive for uniformed workers like mail carriers, nurses, and restaurant workers to do their jobs, and eliminates employer incentives to offer certain benefits.

- It makes tax benefits for individuals temporary, while making corporate tax cuts permanent.

- It will raise taxes on 92 million middle class families over the next 10 years.

And before the ink is even dry, President Trump, Speaker Ryan, and House Republicans are already bragging about how they plan to pay for this nearly $1.5 trillion tax giveaway to millionaires, billionaires, and corporations. How, you ask? By slashing spending on health care, Social Security, nutrition assistance, affordable housing, and other basic living supports that help families make ends meet.

Meanwhile, Congress STILL hasn’t extended the Children’s Health Insurance Program or negotiated a fix for DACA, leaving millions of lives hanging in the balance. This holiday season, GOP priorities are on full display. We won’t soon forget this vote, and you shouldn’t either.