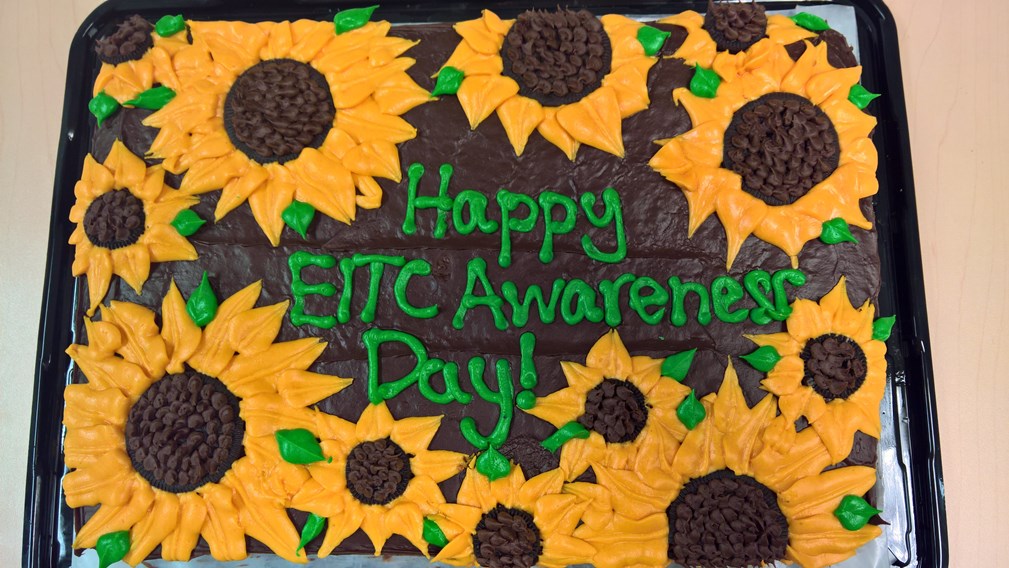

Celebrating EITC Awareness Day

Today, January 27, is EITC Awareness Day. As workers anticipate receiving tax documents from their employers so they can file their 2016 income tax returns, EITC Awareness Day aspires to make sure that workers who may be eligible to claim the Earned Income Tax Credit have this important tax benefit on their radar screens. Along with the Child Tax Credit, the EITC lifted an estimated 9.4 million people – more than half of them children – out of poverty. Despite the tremendous positive economic impact this credit has on millions of families across the country, only about 4 of 5 tax filers who are eligible to claim the credit do so, however.

Today, January 27, is EITC Awareness Day. As workers anticipate receiving tax documents from their employers so they can file their 2016 income tax returns, EITC Awareness Day aspires to make sure that workers who may be eligible to claim the Earned Income Tax Credit have this important tax benefit on their radar screens. Along with the Child Tax Credit, the EITC lifted an estimated 9.4 million people – more than half of them children – out of poverty. Despite the tremendous positive economic impact this credit has on millions of families across the country, only about 4 of 5 tax filers who are eligible to claim the credit do so, however.

That’s where the IRS, policymakers, and national and community-based organizations around the country come in. Together, we are providing resources, sponsoring events, and speaking out to make sure that families know to claim the EITC this year. While we’re sharing information, you should know that NWLC offers state-specific fliers that can be downloaded and shared with families in every state.

This year, it’s especially important for tax filers claiming the EITC to know that their refunds will be held until Feb. 15 – and may not be available until the week of February 27. And some individuals who file their taxes using Individual Tax Identification Numbers may need to renew their ITINs this year.

This EITC Awareness Day, take the opportunity to make sure that families in your community are aware of this important tax benefit. Lifting families out of poverty – now that is something to celebrate.