Trump’s Proposed DOL Rule Is Tip-Poaching, Not Tip-Pooling

Late in 2017, Trump’s Department of Labor (DOL) announced a Notice of Proposed Rulemaking (NPRM) proposing a regulation change that could result in employers stealing as much as $5.8 billion of workers’ tips from employees. Given that women are 2 in 3 tipped workers—and that a whopping $4.6 billion of that $5.8 billion would come from women’s pockets—this new change is poised to strike a heavy blow to women already struggling to make ends meet.

In a nutshell, the DOL is proposing to do away with a 2011 regulation which states unequivocally that tips are the property of the employee who earns them. The current 2011 regulation allows for some limited “tip-pooling” – the practice of tipped workers combining tips and then redistributing them among other employees who normally receive tips, like bartenders – but excludes from any tip-pooling employees who normally would not earn tips, like chefs and janitors. Critically, it also states that employers may not keep any of the employees’ tips.

The National Restaurant Association and their lobbyists are too sneaky to simply change these provisions in the proposed regulation. Instead, they’ve dressed up this rotten rule change and re-branded it as a tool to “decrease wage disparity” among back-of-house and front-of-house workers by redistributing tips among more working people.

But in reality, the proposed regulation would put all the power in the hands of the employer to decide what happens to employee tips. And instead of improving economic security for their employees, the rule would provide an added incentive for employers to keep wages low for back-of-house workers while at the same time, taking away earnings from front-of-house workers. After all, if employers can simply take pay from servers and give it to cooks, why would they spend their own money to raise base wages?

Here’s how the regulation will work: as long as each employee receives the federal minimum wage, the proposed regulations would allow employers to share tips with employees who do not typically receive them—or not to give them to employees at all. In fact, buried on page 51 of the DOL’s own discussion of the potential impacts of the proposed rule, the agency admits that tips could either be redistributed into a tip pool or “otherwise utilized in part (or in full) by the Employer”

Workers and advocates know, and evidence already demonstrates, that even under current law, employers are illegally pocketing worker tips. One study surveying workers in Chicago, Los Angeles and New York found that 12 percent of tipped workers had wages stolen by their employer or supervisor. The Economic Policy Institute now estimates that under the NPRM, employers could line their pockets with an astronomical $5.8 billion dollars taken – legally –from their employees.

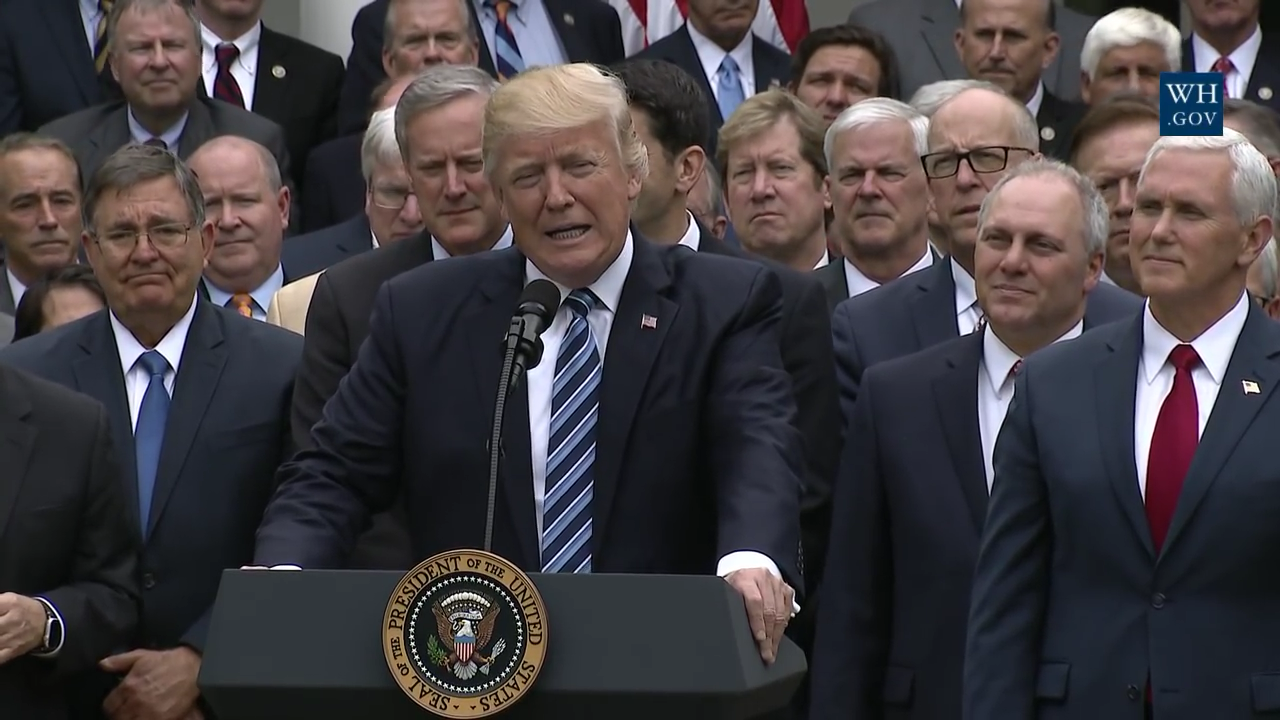

Employers who stand to benefit from this change include President Donald Trump, who owns multiple restaurants and has a lousy track record when it comes to workers’ rights. In fact, in 2015 restaurant workers who worked for a Trump restaurant filed a class action complaint against Trump and others in New York, alleging that Trump stole their tips.

To truly understand why this rule change is so disturbing, it’s important to recognize just how difficult it is to survive as a tipped worker in the United States. Not only do tipped workers face long hours, and difficult work, but poverty rates for tipped workers are more than twice as high as rates for working people overall. One key reason for the high poverty rates is that in many states, employers can pay their tipped employees a minimum cash wage of as little as $2.13 an hour (the minimum required by federal law), with tips making up the rest of their income. To make matters worse, women who have to rely on tips for much of their income often feel forced to tolerate inappropriate behavior from customers; a study by the Restaurant Opportunities Center found that 90% of tipped restaurant workers have experienced some type of sexual harassment or assault in the workplace.

The DOL’s proposed rule exacerbates, rather than alleviates, the economic insecurity and vulnerability to sexual harassment that women in tipped jobs so often face, as they now will be even more vulnerable to harassment and abuse from their employers, who will have the power to decide whether they can keep the tips they receive. And the fact that an employer must pay a tipped employee the federal minimum wage of $7.25 before gaining control over her tips under the new rule does little to change the employee’s dependence on those tips; $7.25 an hour leaves a mother supporting one or two children thousands of dollars below the poverty line, even if she works full time.

Instead of making it legal for employers to steal employee tips, the DOL should be encouraging employers who rely on tipped workers for their profits to adopt policies and practices that protect employees from sexual harassment and assault at work. And the agency should promote raising the minimum wage and abolishing the lower tipped minimum wage altogether so that all working people – tipped and non-tipped alike – can count on a fair minimum wage. People who rely on tips to survive should not have to see them stripped away by a rule that shows a callous disregard for the hard work of service workers all over the United States. The DOL should stand with working people and withdraw this proposed rule.