Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

House and Senate Tax Bills Are A Bad Deal for Women

Yesterday, Republicans in the House and Senate moved forward with tax plans benefitting millionaires, billionaires, and corporations. The House Ways and Means Committee passed an amended version of the Tax Cuts and Jobs Act Republicans introduced last week. Later in the day, Republicans in the Senate Committee on Finance released their tax bill.

While there are some differences between the two versions, they have the same purpose and would have the same effect. Both would make women and families pay for tax cuts for the wealthiest individuals and corporations through harmful changes to tax benefits women and families rely on and by increasing the deficit, threatening vital programs that women and families rely on for their economic security.

Both the House and Senate GOP bills give crumbs to everyday women and families.

House and Senate Republicans are selling their tax plan as a boost to working families, but the details show that many low- and middle-income families are actually the losers in the plan.

- The House and Senate purport to “double” the standard deduction, but offset that increase by eliminating personal exemptions. As we said before, the standard deduction increase from $13,000 to $24,400 for a married couple (2018 value) is paired with the elimination of personal exemptions (valued for 2018 at $4,150 for the taxpayer and each dependent). This would translate into tax increases for many families, especially those with children.

- The House bill limits the deduction for state and local taxes, and the Senate GOP bill goes further in repealing it altogether. Repealing the deduction for state and local taxes would be a hard hit for families in states like New Jersey, Maryland, and Connecticut with higher state and local taxes and high participation in this deduction. Repealing this deduction would contribute to the tax increase for millions of families over the next decade. It would also likely lead to many states and localities reducing their tax rates, leaving less revenue for critical state and local programs. Oh, and did we mention that both the House and Senate bills repeal this deduction for individuals filing taxes, but corporations can still claim the deduction as a business expense? How does that help make the tax code fairer for ALL of us?

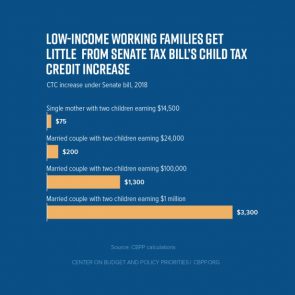

The House and Senate GOP tax bill proposals around the Child Tax Credit don’t do enough for low-income families and do too much for high-income ones. The Senate bill’s Child Tax Credit (CTC) increase is a whopping $50 more than the increase in the House bill ($600). Unlike other proposals to improve the CTC, many low-income families would see little, if anything, from this increase. Both bills would make the credit available to higher income families; however, millionaires would be eligible under the Senate version. The Senate bill also contains a harmful provision, identical to one in the amended House bill, that would take the refundable portion of the CTC away from low-income children with Individual Tax Identification Numbers (ITINs).

The House and Senate GOP tax bill proposals around the Child Tax Credit don’t do enough for low-income families and do too much for high-income ones. The Senate bill’s Child Tax Credit (CTC) increase is a whopping $50 more than the increase in the House bill ($600). Unlike other proposals to improve the CTC, many low-income families would see little, if anything, from this increase. Both bills would make the credit available to higher income families; however, millionaires would be eligible under the Senate version. The Senate bill also contains a harmful provision, identical to one in the amended House bill, that would take the refundable portion of the CTC away from low-income children with Individual Tax Identification Numbers (ITINs).- The House and Senate bills propose a slower index for inflation, which would contribute to increased taxes for many families over the next 10 years. Nonpartisan analysis of the House bill estimates that, by 2027, nearly one-third of middle-class families would pay more in taxes.

Both the House and Senate GOP bills give vast benefits to millionaires, billionaires, and big corporations.

While women and families get tiny tax benefits, the super-rich and big corporations would receive large, permanent, and costly tax cuts. Here’s a glimpse of how the Senate and House GOP tax bills propose cutting taxes for the wealthiest among us:

- Lowering the top individual tax rate. The House bill maintains the top tax rate at current 39.6 percent, though raising the income threshold to over $500,000 for individuals (over $1 million for couples filing jointly). The Senate gives a bigger tax break to the wealthiest by lowering the top rate to 38.5 percent.

- Slashing taxes for wealthy corporations. Many corporations currently pay little or no taxes, and Americans don’t want a corporate tax cut in a tax reform bill. Yet both the House and Senate GOP tax bills propose cutting the top statutory corporate tax rate from 35 percent to 20 percent. While the Senate bill would delay that cut to 2019 instead of 2018, the tax cut would still result in billions in lost revenue—another tax cut for those who don’t need it that women and families will have to pay for later.

- Giving tax breaks to those inheriting more than $5 million. The House bill proposes repealing the estate tax in 2024, even though that tax currently only applies to two out of every 1,000 estates. The Senate bill does not propose repealing the estate tax; instead doubling the current exemption of $5 million from the estate tax to $11 million per person ($22 million per couple). Doubling this exemption would mean that only 1,800 estates in the entire United States would have to pay the estate tax, and those estates would receive a tax cut of $4.4 million per couple—enough to help 1,100 students attend college with Pell Grants.

Both GOP tax plans will lead to trillions in cuts to vital programs and services helping women and families.

The 2018 budget resolution allows Congress to pass a tax cut that will increase the deficit by $1.5 trillion. Based on past budget proposals and the 2018 budget resolution itself, Republicans will seek to pay for these major tax cuts to millionaires, billionaires, and big corporations through cuts to critical programs helping women and families in the future. Health care, education, food assistance, and more programs are critical to the economic security of low-income women and their families. Congress should be increasing investments in these critical programs, not cutting them in order to pay for tax cuts for the wealthiest among us who do not need them.

Despite the differences between the new Senate Finance bill and the bill the House will consider next week, the overall picture is the same—the GOP tax plan will ask women and families to pay for tax cuts for millionaires, billionaires, and wealthy corporations. We deserve better.