Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

Disability Insurance (DI) is a core component of Social Security’s old age, survivor, and disability insurance (OASDI) program. Workers earn disability insurance protection by working and contributing to the Social Security program. In turn, the program insures workers who have suffered a serious and long-lasting disability, providing modest but essential income to support them and their families if they are unable to work. It is through near universal worker participation – and pooled risk – that Social Security is able to provide benefits to workers and their families for a fraction of what similar protection would cost in the private market. As women’s labor force participation has increased, so has the importance of DI to their economic security.

Disability Insurance (DI) is a core component of Social Security’s old age, survivor, and disability insurance (OASDI) program. Workers earn disability insurance protection by working and contributing to the Social Security program. In turn, the program insures workers who have suffered a serious and long-lasting disability, providing modest but essential income to support them and their families if they are unable to work. It is through near universal worker participation – and pooled risk – that Social Security is able to provide benefits to workers and their families for a fraction of what similar protection would cost in the private market. As women’s labor force participation has increased, so has the importance of DI to their economic security.

Nearly equal numbers of men and women now receive DI.

- In DI’s early years, male recipients vastly outnumbered women. Over time, as women’s labor force participation has increased, more and more women have worked enough to be insured by DI. As a result, women now make up nearly half of all DI recipients.

Millions of women and children rely on income from DI.

- More than 4.3 million women received DI benefits as disabled workers in December 2015.

- Nearly 142,000 additional women received benefits as the spouse of a disabled worker, representing 94 percent of those receiving benefits as the spouse of a disabled worker.

- More than 1.7 million children of disabled workers receive support from DI benefits.

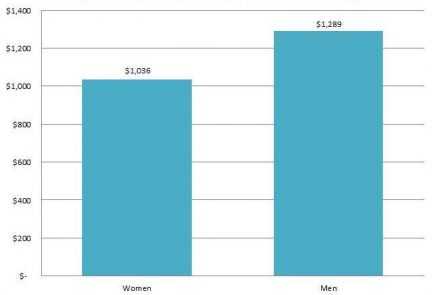

Average Monthly Social Security DI Benefits in 2015 by Sex

Source: U.S. Social Security Administration, Annual Statistical Supplement to the Social Security Bulletin, 2016, Table 5.E2.

DI benefits are modest, but critically important for those who receive them.

- A person under 65 needed $12,331 in annual income – about $1,028 in income each month – just to make it to the federal poverty line in 2015.

- The average DI benefit for female disabled workers in 2015 was just over the federal poverty level at, $12,432 per year (or $1,036 per month); for male disabled workers, the average benefit was $15,468 per year (or $1,289 per month).

- Indeed, even with income from DI, more than 1 in 5 (22.7 percent) female disabled worker beneficiaries and about 1 in 6 (16.6 percent) male disabled worker beneficiaries are poor. But without income from DI, nearly half (49.1 percent) of all disabled worker beneficiaries would be poor.

Policymakers need to make sure SSDI is maintained and strengthened, not cut.

- DI benefits are financed by Social Security payroll taxes. Of the 6.2 percent of earnings (up to a cap of $118,500 in 2017) paid by workers and their employers, 5.3 percent goes into the Old-Age and Survivors Insurance (OASI) Trust Fund and 0.9 percent goes into the Disability Insurance (DI) Trust Fund.

- DI is fully financed until 2023; however, at that point the DI Trust Fund will be exhausted and contributions will cover only 89 percent of benefits.

- In order to ensure beneficiaries continue to receive Social Security’s essential benefits, Congress has shifted the allocation of the payroll tax to rebalance the Trust Funds twelve times in recent history.

- Policymakers can strengthen the Social Security program and ensure it is able to continue providing essential benefits. One way they can do so is by requiring higher earners to pay Social Security taxes on all their earnings.