Extremist judges will not stop endangering the lives of pregnant people or people who may become pregnant—overturning Roe v. Wade, attacking medication abortion, threatening the future of IVF, and this week at SCOTUS, emergency abortion care.

Our lawyers are waging strategic fights that make clear what is at stake for people who can become pregnant and seek to bolster our fundamental rights to control our lives, futures, and destinies.

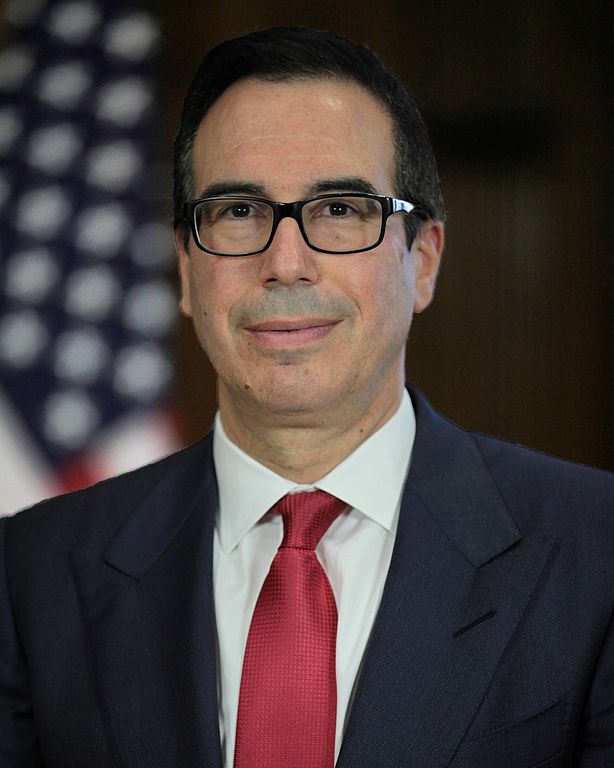

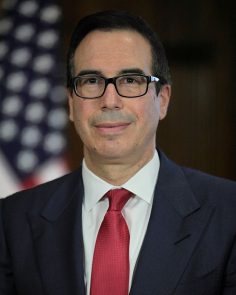

President-Elect Donald Trump has nominated Steven Mnuchin, his campaign’s financial advisor, to serve as Secretary of the Treasury, a position made famous by Alexander Hamilton and made cool by Lin-Manuel Miranda. The Treasury Department oversees our international monetary and trade policy, collects taxes, and enforces laws related to finance and taxes. They are responsible for maintaining a secure financial sector, by ensuring that risks are properly managed and outside actors cannot intentionally destabilize the economy. With such a broad array of responsibilities, the Treasury Secretary has a major effect on the economic security of vulnerable communities, including women and families, impacting the investments that are available to them, the cost of those investments, tax collection, and the overall economy. Notably, the position has

President-Elect Donald Trump has nominated Steven Mnuchin, his campaign’s financial advisor, to serve as Secretary of the Treasury, a position made famous by Alexander Hamilton and made cool by Lin-Manuel Miranda. The Treasury Department oversees our international monetary and trade policy, collects taxes, and enforces laws related to finance and taxes. They are responsible for maintaining a secure financial sector, by ensuring that risks are properly managed and outside actors cannot intentionally destabilize the economy. With such a broad array of responsibilities, the Treasury Secretary has a major effect on the economic security of vulnerable communities, including women and families, impacting the investments that are available to them, the cost of those investments, tax collection, and the overall economy. Notably, the position has