The Trump Administration is Trying to Make Filing Taxes Suck Even More

Filing taxes is no one’s favorite pastime—and the Trump administration is trying to make it worse. While millions of people in the U.S. are trying to compete their tax returns before April 15, the administration is trying to undermine the programs and staff dedicated to helping families file and claim their tax benefits. This will especially hurt women and families, who benefit more from refundable tax credits, such as the Child Tax Credit and Earned Income Tax Credit, that can be confusing to claim on your own.

Here are just some of the ways the Trump administration is making it harder for you to file your taxes this year.

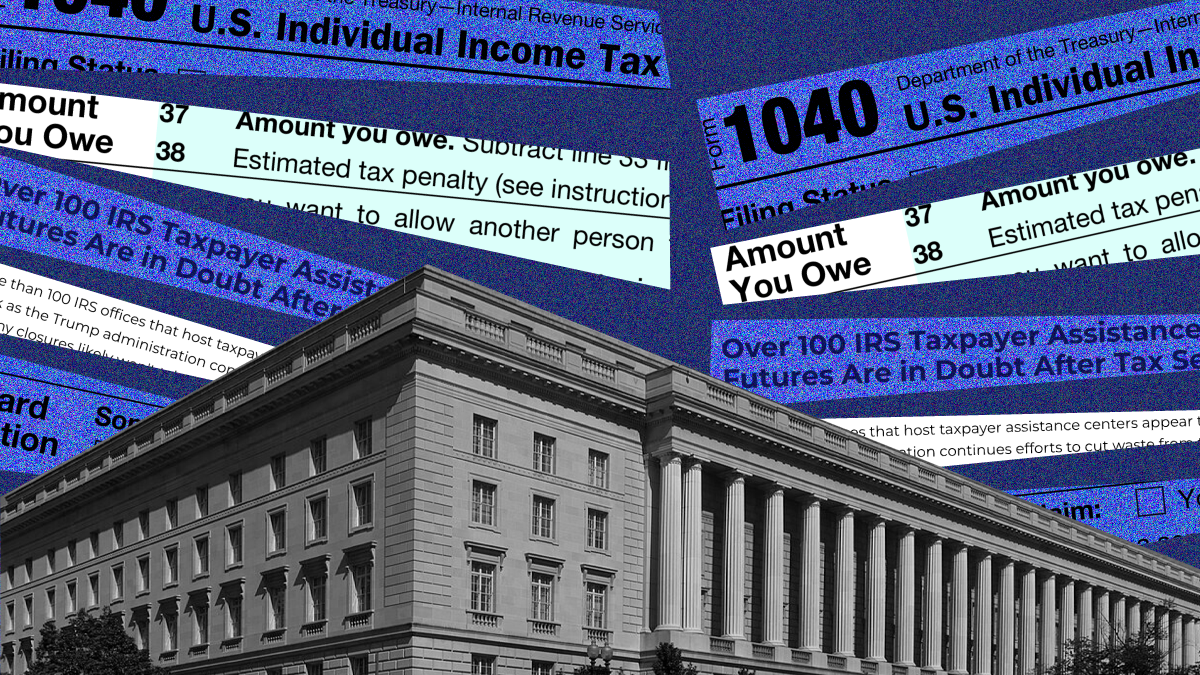

Closing IRS taxpayer assistance centers that help families

As part of its illegal efforts to dismantle the federal government, the Trump administration is expected to close around 120 of the IRS’ taxpayer assistance centers—about a third of the centers in the country. These centers are essential to helping improve customer service at the IRS and helping families file their taxes. And thanks to increased funding, the staff at these centers are serving 37% more families in 2024 than the year before. While recent reports suggest that the closures won’t happen until after tax season, we still expect the chaos and uncertainty to impact the numbers of families these centers will be able to help this year.

Making it easier for the rich to cheat on their taxes by firing IRS employees

Not only are Trump and Elon Musk’s DOGE trying to make it harder for families to file their taxes, they’re also making it easier for the wealthy to cheat on theirs. The administration just laid off approximately 7,000 IRS employees, the majority of whom had been recently hired to enforce tax compliance, including by going after uncollected taxes from wealthy tax cheats. Under court orders, the IRS reinstated these employees—but they will not return to work until the day before Tax Day. Additionally, the IRS has plans to cut nearly a fourth of its workforce starting April 11, and to ultimately cut up to 50% its enforcement personnel this year and next.

These layoffs will undoubtedly slow or possibly even stop the new enforcement efforts against wealthy people, even though the IRS has already successfully collected $1.3 billion in delinquent taxes from high-income filers as of September. In fact, some IRS officials are predicting that the agency will lose $500 billion in revenue this tax season, because wealthy tax cheats know that the IRS doesn’t have the manpower to go after them. Apparently, Trump would rather attack immigrants and slash programs for women and families than make sure the wealthy pay their fair share. And the layoffs will likely impact customer service and slow down tax return processing, meaning families will have to wait longer for their tax returns.

Trying to steal private taxpayer data to attack immigrant families

In addition to cutting staff and programs, the Trump administration is also stealing people’s private tax data. As part of its barrage of attacks on immigrant families, the administration has arranged for the IRS to hand over private taxpayer information from immigrant families to enable ICE’s mass deportations. Immigrants make up one in seven U.S. residents and many immigrants who lack Social Security Numbers pay taxes. In 2022, undocumented immigrant taxpayers paid $96.7 billion in federal, state, and local taxes (while some billionaires pay nothing at all)—contributing to programs like Medicaid, Social Security, and unemployment insurance. For so many immigrants and their families, this means paying into public benefits that they are largely excluded from accessing. This unlawful overreach by the administration will cost the government billions in lost revenue, punish families who voluntarily participate in the tax system, and put everyone’s tax information in danger.

***

In short: the Trump administration is making it easier for billionaires to get away with tax fraud while making it harder for regular families to file their taxes. We’re waiting to see just how harmful Trump’s attacks on the IRS prove to be. For now, there are still programs and resources available to help families file their taxes and claim their benefits this tax season. This includes the IRS’s Direct File program, which allows families to file with the IRS directly, easily, and for free.