Abortion rights, women of color, and LGBTQI+ people are under attack. Pledge to join us in fighting for gender justice.

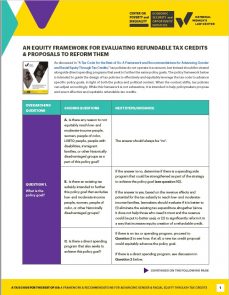

As discussed in A Tax Code for the Rest of Us, a report co-authored by Indivar Dutta-Gupta, Kali Grant, and Funke Adenronmu (Georgetown Center on Poverty and Inequality), Melissa Boteach and Amy Matsui (NWLC), tax policies do not operate in a vacuum, but instead should be viewed alongside direct spending programs that seek to further the same policy goals. This fact sheet provides a policy framework to guide the design of tax policies to effectively and equitably leverage the tax code to advance specific policy goals, in light of both the policy and political context. When the context shifts, tax policies can adjust accordingly. While this framework is not exhaustive, it is intended to help policymakers propose and enact effective and equitable refundable tax credits.

As discussed in A Tax Code for the Rest of Us, a report co-authored by Indivar Dutta-Gupta, Kali Grant, and Funke Adenronmu (Georgetown Center on Poverty and Inequality), Melissa Boteach and Amy Matsui (NWLC), tax policies do not operate in a vacuum, but instead should be viewed alongside direct spending programs that seek to further the same policy goals. This fact sheet provides a policy framework to guide the design of tax policies to effectively and equitably leverage the tax code to advance specific policy goals, in light of both the policy and political context. When the context shifts, tax policies can adjust accordingly. While this framework is not exhaustive, it is intended to help policymakers propose and enact effective and equitable refundable tax credits.