Abortion rights, women of color, and LGBTQIA+ people are under attack. Pledge to join us in fighting for gender justice.

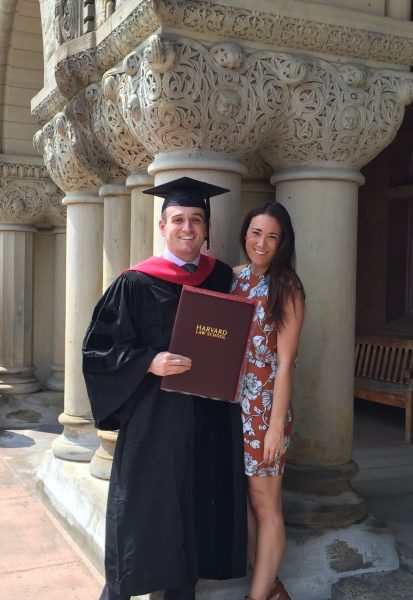

Without the ACA, I May Have Never Met My Fiancé

At 26 years old, before I knew him, my fiancé, Alex, was living in Los Angeles, trying to make it as a screenwriter. He was young, talented, and in an exciting city looking for the opportunities that could further his career. He was constantly surrounded by celebrities and his screenwriting icons. From what I have heard, the Hollywood parties weren’t bad either. It sounds glamorous, but in reality, because television shows don’t shoot year-round and movies wrap once they are released – he was hopping from one low-paying production job to another with periods of unemployment in between. In trying to “make it” in Hollywood, while also trying to pay for rent, food, and a car, getting health insurance coverage was the last thing on his mind.

Before passage of the Affordable Care Act (ACA), he would have opted to forgo health insurance. At age 26, he was too old to be covered under his parents’ employer-sponsored health insurance plans, he made too much money to be eligible for Medicaid, and his often short-term jobs in the entertainment industry did not offer benefits. Before the ACA, purchasing private, individual insurance coverage was difficult, expensive, and often left people with much lower-quality coverage than employer-sponsored plans. And as a young, healthy man with bills to pay and dreams to accomplish, he couldn’t afford to set aside the $300 a month it would have cost to purchase health insurance in the private market.

But after the passage of the ACA, people like Alex suddenly had access to affordable health insurance options. The ACA included a lot of good options for young adults, including allowing dependents to stay on their parents’ plans until age 26 and making health insurance more affordable. In fact, seven in ten people can now get health insurance for less than $75 a month through the ACA’s marketplaces.

Alex made the decision to get covered with help from the ACA. And it was a good thing he took this opportunity. One morning in 2012, while walking across the street, he was hit by a speeding car. He was rushed to the emergency room in an ambulance where he received x-rays and an MRI. Thankfully, he wasn’t critically injured. But after his release from the hospital, he learned that the driver’s insurance company was fighting the claim, so Alex, who couldn’t afford to take the case to court, was left with the whole bill.

Without health insurance, these bills would have totaled in the thousands. Even though he wasn’t badly injured, the bills from the accident could have sent him into serious medical debt. And medical debt severely threatens financial security. Because of medical debt, individuals often fall behind in paying for basic necessities such as rent, food, and utilities. Medical debt can also affect your credit score and individuals have been turned down for mortgages and student loans as a result.

Luckily, thanks to the ACA, Alex did have health insurance. The ACA limits out-of-pocket costs and provides subsidies to purchase health insurance – all which help to keep costs down for individuals and families and limits their exposure to the risks of medical debt. In Alex’s case, because insurance covered his expenses, he avoided medical debt and financial instability. Thanks to the coverage he got because of the ACA, Alex was approved for student loans two years later when he was accepted to Harvard Law School. And thanks to the ACA, he attended law school, where we met, joined the same study group, and got engaged two years later.

Alex’s story could have turned out a lot differently if he hadn’t had health insurance made possible by the ACA. You never know when you may get hit by a speeding car. Likewise, you never know when you may need health insurance. Fortunately, getting covered under the ACA is as easy as visiting HealthCare.gov and signing up for the coverage that fits your needs. Enroll now so that you and your loved ones can #GetCovered and to ensure that medical debt doesn’t hold you back from a bright future.