The Trump Budget: Ineffective, Inefficient, and Just Plain Terrible for Women and Families

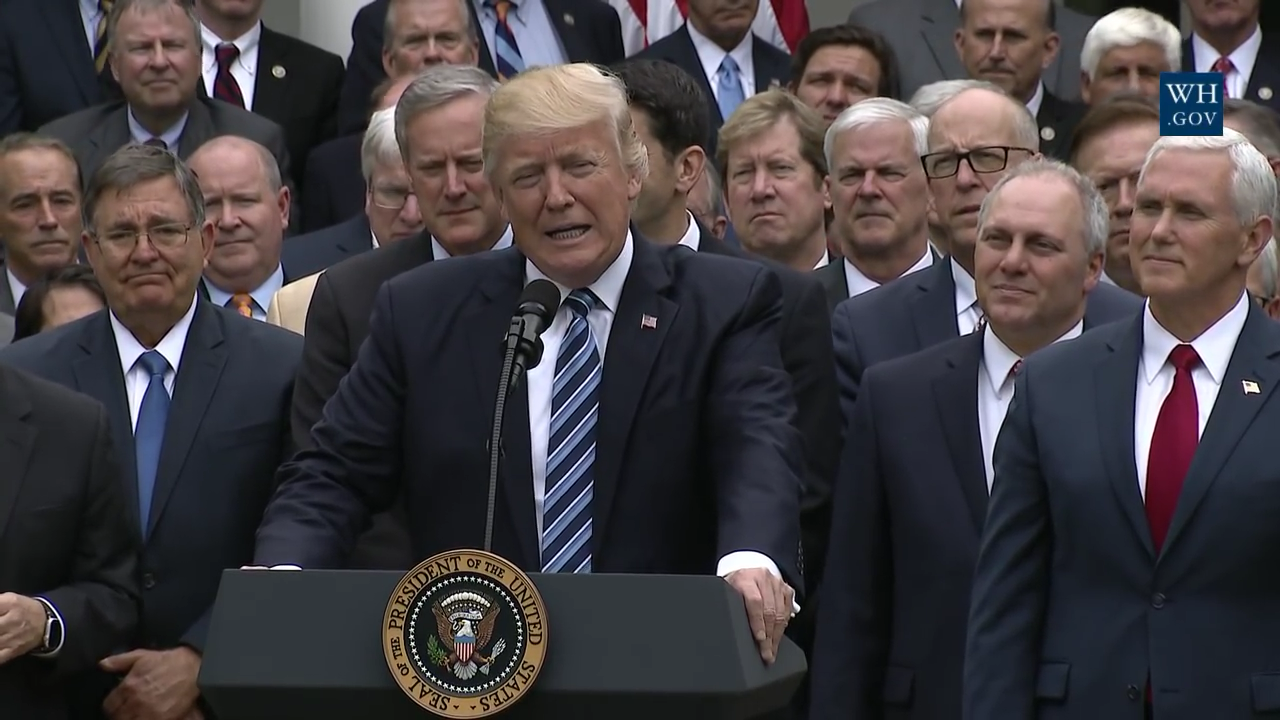

You may have heard it before, but it bears repeating: budgets reflect priorities. Last year, Congressional Republicans passed a budget resolution for FY 2018 with backwards priorities—increase the deficit by $1.5 trillion in order to deliver vast tax cuts to the wealthy and large corporations, threatening the future of vital programs for women and their families. And in December, President Trump signed $1.5 trillion in tax giveaways to millionaires, billionaires, and corporations into law—which we know means the brutal program cuts are coming.

You may have heard it before, but it bears repeating: budgets reflect priorities. Last year, Congressional Republicans passed a budget resolution for FY 2018 with backwards priorities—increase the deficit by $1.5 trillion in order to deliver vast tax cuts to the wealthy and large corporations, threatening the future of vital programs for women and their families. And in December, President Trump signed $1.5 trillion in tax giveaways to millionaires, billionaires, and corporations into law—which we know means the brutal program cuts are coming.

Sure enough, this week, the Trump Administration released its backwards budget plan for fiscal year (FY) 2019, which deepens the threats to vital programs in order to pay for tax cuts for the wealthy. Though just last week Trump signed a compromise to lift dangerous sequester caps for defense and non-defense discretionary spending to address vital needs such as child care, health care, education, and more (while shamefully failing to pass a solution so that hundreds of Dreamers do not continue losing their Deferred Action for Childhood Arrivals (DACA) status every day), his budget runs in the opposite direction, proposing dramatic cuts to programs that help everyday women and families make ends meet. The budget proposal tries to disguise many of these cuts as workforce initiatives focused on “moving able-bodied Americans back into the workforce,” but they actually hinder people’s ability to work.

To name just a few of the budget’s truly terrible ideas:

- It continues efforts to repeal the Affordable Care Act (ACA), roll back Medicaid, and block women’s access to reproductive health care. The new tax law already guts the ACA and will cause 13 million people to lose their health care coverage. Not content to leave bad enough alone, Trump’s budget proposes repealing the ACA in its entirety—including eliminating critical federal protections for people with pre-existing conditions, which will increase health care costs and leave millions of women to once again be treated as a pre-existing condition. And it eviscerates Medicaid, which would particularly harm the 17 million low-income women nationwide ages 18-64 who rely on Medicaid for health coverage. The Budget also supports the Administration’s existing efforts to force people to work in order to receive Medicaid —ignoring the reality that most nonelderly, adult Medicaid enrollees already work and, more importantly, that taking away someone’s health care will not help them find full-time work, get over an illness preventing them from working, or care for children or family members.

And just in case there was still any doubt about how this Administration feels about women’s access to reproductive health care, the budget opens the door for states to discriminate against providers like Planned Parenthood, restricting patient access to providers of preventive care. The budget also continues the Administration’s prioritization of personal beliefs over patient care by supporting refusals to provide abortion based on personal beliefs, compromising women’s access to the care that they need.

- It guts vital nutrition assistance and other key supports for families facing obstacles like a job loss or unpredictable hours at work. The Supplemental Nutrition Assistance Program (SNAP, or food stamps) helps people facing these obstacles feed their families and leads to improved health, education, and other outcomes for low-income children. More than 40 million people use SNAP benefits each month—and women make up the majority of adults who use the program. Benefits, however, are at a low average of $1.40 per person per meal. Instead of making investments to improve SNAP benefits, Trump’s budget proposal slashes funding for SNAP by $213 billion over ten years. In addition, it proposes more work requirements for SNAP beneficiaries, even though the majority of adult recipients who can work, do work. It also cuts support for the already inadequate Temporary Assistance for Needy Families (TANF) program and eliminates altogether the Low Income Home Energy Assistance Program, the Community Development Block Grant, and the Community Services Block Grant—all programs that help support basic living standards for families going through tough times.

- It attacks education by proposing to shift resources from public schools to private schools, cut resources for the office charged with protecting students from discrimination, and increase the burden of repaying student loans. Trump’s budget proposal fails to make needed investments for students of all ages. It cuts several traditional public education programs in order to direct more public money to “school choice,” and private school vouchers even though evidence shows that voucher programs may lower student achievement. It would cut $1 million from the Department of Education’s Office for Civil Rights instead of providing more resources to address discrimination complaints. It proposes policy changes to increase the student loan repayment burden for those who pursue graduate education. Furthermore, the budget attacks public service by proposing to ELIMINATE the Public Service Loan Forgiveness program, a valuable program for those with student loans who choose to commit to lower-paying public service careers rather than high-paying corporate jobs.

- It includes infrastructure proposals that provide small “investments” in infrastructure with one hand while cutting vital infrastructure investments with the other. Trump’s budget was released the same day as his infrastructure proposal. While claiming to generate at least $1.5 trillion in investments to fix our nation’s crumbling infrastructure, the budget invests just $200 billion in federal dollars—while making deep cuts to many of the agencies responsible for infrastructure development. Trump’s sham infrastructure plan puts the burden of fixing our infrastructure on state and local governments and public-private partnerships–but Congressional Republicans and President Trump just capped the value of deductions on state and local taxes, inhibiting their ability to collect taxes for vital services such as…you guessed it, infrastructure. As for the public-private partnerships, there is much uncertainty about how much the public will pay for private infrastructure work through, for example, tolls and parking fees.

- It cuts vital housing assistance programs on which millions of low-income families rely for shelter and raises their rent. Trump’s budget proposes cutting the Department of Housing and Urban Development (HUD) programs by $6.8 billion, which would have devastating impacts on efforts to combat homelessness. The budget fails to fully fund Section 8 housing assistance, which would lead to 200,000 low-income households losing their vouchers. It cuts public housing funding nearly in half and eliminates the HOME Investment Partnerships, Community Development Block Grant (CDBG), and Choice Neighborhood programs that offer aid to rural and urban low-income communities. The budget also embraces a proposal, leaked last week, that would allow public housing agencies to end rental assistance for people who do not meet – shocker! – still more new work requirements, and/or increase rent for “able-bodied individuals,” most of whom are low-wage workers with very little (if any) room in their own budgets to pay more rent on top of food, utilities, and work expenses like transportation and child care. Raising low-wage workers’ rents or cutting off assistance to unemployed or underemployed people will not help anyone find full-time work—it will just make more families homeless.

- It cuts Social Security benefits for people with disabilities. The Social Security Disability Insurance Program(SSDI) is a critical part of Social Security and insures workers who have suffered serious and long-lasting disabilities. As women’s labor force participation has increased, so has their use of the SSDI benefits, and women now make up nearly half of all SSDI beneficiaries. The Trump budget’s proposal to cut SSDI breaks his promise to protect Social Security and would be devastating to women.

- It undermines workplace protections for women and only pays lip service to paid leave. At a moment when the #MeToo phenomenon has made clearer than ever the obstacles women still face at work, Trump’s budget proposes slashing funding for the Department of Labor’s Women’s Bureau by about 75 percent; the Women’s Bureau is the only federal office solely dedicated to advancing the interests of women in the workplace, through research, public education, policy development, and advocacy. It also eliminates the Women in Apprenticeships and Nontraditional Occupations (WANTO) program, which helps women enter nontraditional—and often higher-paying—fields, and cuts funding for civil rights enforcement.

These cuts threaten real harm to working women and demonstrate ongoing hostility to the calls across the country for meaningful solutions to workplace harassment and other forms of discrimination. In case Trump is wondering, we won’t be distracted or appeased by the inclusion of the same underwhelming paid leave plan that was tossed into last year’s budget, which provides an inadequate amount of leave to an inadequate number of people (new parents only, ignoring the needs of millions of people who need paid time to care for themselves or loved ones when they are battling serious medical conditions).

While corporations and the wealthy celebrate their $1.5 trillion tax cut, the Trump budget proposes widening inequality in this country through devastating cuts impacting nearly every aspect of women’s lives. Instead of prioritizing the wealthy few and big corporations, the Administration and Congress must start addressing the pressing needs of women and their families. This means protecting Dreamers, acting on the recent agreement to provide relief for victims of natural disasters and increase investments in non-defense discretionary spending, and addressing vital unmet needs in health care, child care, education, and more programs that are critical to the economic security of women and families.