As a second Trump administration approaches, we’re running out of time to confirm as many federal judges as possible to provide a check on his presidential power and curb his stated policy priorities.

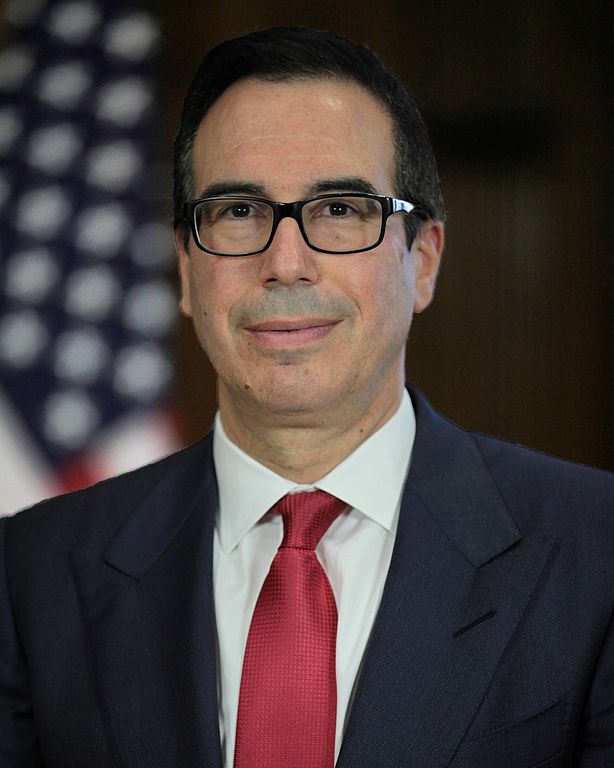

Three Things to Know About Steven Mnuchin

President-Elect Donald Trump has nominated Steven Mnuchin, his campaign’s financial advisor, to serve as Secretary of the Treasury, a position made famous by Alexander Hamilton and made cool by Lin-Manuel Miranda. The Treasury Department oversees our international monetary and trade policy, collects taxes, and enforces laws related to finance and taxes. They are responsible for maintaining a secure financial sector, by ensuring that risks are properly managed and outside actors cannot intentionally destabilize the economy. With such a broad array of responsibilities, the Treasury Secretary has a major effect on the economic security of vulnerable communities, including women and families, impacting the investments that are available to them, the cost of those investments, tax collection, and the overall economy. Notably, the position has never been held by a person of color or a woman.

President-Elect Donald Trump has nominated Steven Mnuchin, his campaign’s financial advisor, to serve as Secretary of the Treasury, a position made famous by Alexander Hamilton and made cool by Lin-Manuel Miranda. The Treasury Department oversees our international monetary and trade policy, collects taxes, and enforces laws related to finance and taxes. They are responsible for maintaining a secure financial sector, by ensuring that risks are properly managed and outside actors cannot intentionally destabilize the economy. With such a broad array of responsibilities, the Treasury Secretary has a major effect on the economic security of vulnerable communities, including women and families, impacting the investments that are available to them, the cost of those investments, tax collection, and the overall economy. Notably, the position has never been held by a person of color or a woman.

As with the vast majority of Trump’s other Cabinet nominees, Mr. Mnuchin’s record raises concerns about how vulnerable communities would fare under his tenure as Treasury Secretary. As we head into Mr. Mnuchin’s confirmation hearing, here are three things to you need to know:

- Mnuchin is commonly referred to as the “foreclosure king,” for his role as the chair of a bank that was responsible for nearly 40 percent of foreclosures during the housing crisis. Because of his egregious conduct foreclosing on mortgages during the financial crisis, Mr. Mnuchin, formerly CEO and Chairman of OneWest Bank, was dubbed the “foreclosure king.” Mnuchin’s investment group purchased the failed bank IndyMac from the federal government, renaming it OneWest Bank. Under his watch, OneWest was responsible for 40 percent of reverse-mortgage disclosures during the crisis, even though it had a 20 percent market share. While Mnuchin was Chair, OneWest even went so far as to foreclose on a 90-year-old woman who accidentally sent in a check that was 27 cents short. Mr. Mnuchin’s role in the foreclosure crisis, which disproportionately affected women and communities of color, draining wealth from vulnerable populations and often leaving them homeless, raises grave concerns about whether he would give sufficient attention to the needs of vulnerable communities affected by Treasury Department decisions.

- Mnuchin led Goldman Sachs’ mortgage department which created the financial instruments that played a large role in causing the financial crash in 2008. Mr. Mnuchin is a former hedge fund manager and worked at Goldman Sachs for 17 years. Most notably, Mnuchin led Goldman Sachs’ mortgage department when it created collateralized debt obligations and credit default swaps. These complicated mortgage products have been blamed for playing a large role in the global economic collapse in 2008 because they encourage riskier lending practices and are essentially betting that debt won’t be repaid. When people who held those mortgages then defaulted on their loans, Mnuchin turned around and made money off of them by investing in and leading OneWest, a bank that foreclosed on more mortgages than most banks its size, as outlined above. So while American families were losing their homes and suffering, Mnuchin sat pretty through the crisis that he had a hand in creating.

- Mnuchin has not made plans to remove all his potential conflicts of interest. In his financial disclosure, Mr. Mnuchin stated that he would divest from many of his investments. These include investments in a hedge fund run by Leon Cooperman, who is being accused of insider trading, and a hedge fund managed by Och-Ziff, which pled guilty to foreign bribery last year. He plans to sell investments in Fannie Mae and Freddie Mac, whose stock prices rallied after his nomination when he said that he would focus on privatizing the two lenders. However, he does not plan to sell his own business, Steven T. Mnuchin, Inc., which he uses to manage some of his own investments. Mnuchin has said he did not intend to resign as the president of his company, but has not said he would place his investments in a blind trust. And although he has said that he will not be personally involved in any matters that could directly affect the assets held by that company, there is no way to tell if any conflicts of interest are actually resolved. Moreover, it has recently come out that Mnuchin failed to disclose over $100 million in assets before his hearing.

Based on Steven Mnuchin’s record, there are serious concerns about whether he will be able to protect the interests of all Americans, or whether he will cater to the interests of the financial elite. Senators should thoroughly question him on this record during his hearing on January 19th, because the American people deserve to know if Mnuchin will prioritize their interests as Secretary of the Treasury.