Abortion rights, women of color, and LGBTQI+ people are under attack. Pledge to join us in fighting for gender justice.

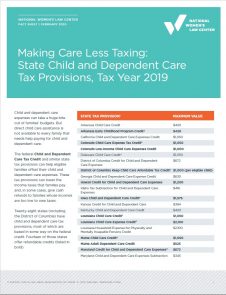

Tax provisions for child and dependent care expenses can provide some help to families struggling to pay for the care they need to support their families. The tax codes of the federal government and over half the states have some type of child and dependent care (CADC) tax provision that reduces the amount of tax owed by families and, in some instances, increases their tax refunds. This fact sheet provides the maximum value for these state CADC tax provisions.

Tax provisions for child and dependent care expenses can provide some help to families struggling to pay for the care they need to support their families. The tax codes of the federal government and over half the states have some type of child and dependent care (CADC) tax provision that reduces the amount of tax owed by families and, in some instances, increases their tax refunds. This fact sheet provides the maximum value for these state CADC tax provisions.