Abortion rights, women of color, and LGBTQI+ people are under attack. Pledge to join us in fighting for gender justice.

The Tax Relief We Need in the Next COVID-19 Package

Next week, Senate Majority Leader McConnell is expected to release Senate Republicans’ proposal for the next COVID-19 relief package. Earlier this week, White House economic advisor Larry Kudlow confirmed that another package was imminent, and stated that the goal is to make the relief “targeted” and “pro-growth.”

Next week, Senate Majority Leader McConnell is expected to release Senate Republicans’ proposal for the next COVID-19 relief package. Earlier this week, White House economic advisor Larry Kudlow confirmed that another package was imminent, and stated that the goal is to make the relief “targeted” and “pro-growth.”

Among the “grab bag” of proposals that might be in the upcoming package, Kudlow named not only (some) additional unemployment relief and another round of Economic Impact Payments, but also a payroll tax holiday and a capital gains tax holiday.

We’ve talked about the reasons that a payroll tax idea is a terrible idea and wouldn’t help the people who are struggling the most. A capital gains tax break means people would pay fewer taxes on the increased value of their investments and assets, and is the very opposite of “targeted” relief when almost 40 percent of families lacked cash on hand to meet an emergency $400 expense even before the pandemic.

If the idea is that tax relief in the next COVID package would be targeted and stimulate growth in the economy, I’ll make a suggestion: expand the Earned Income Tax Credit and the Child Tax Credit.

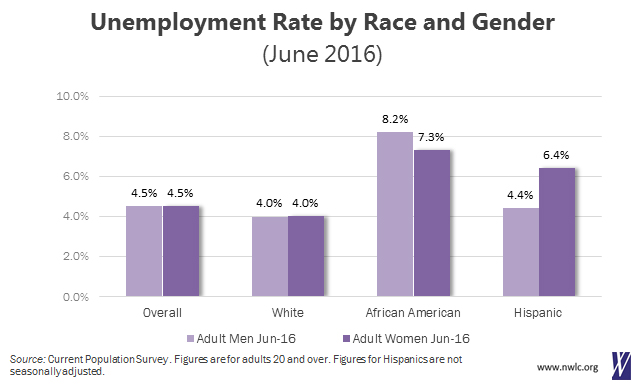

Here’s why: these credits help households with low incomes. Women of color are overrepresented among low-paid workers and especially benefit from the EITC and CTC. Millions of families will see their incomes drop in 2020, after losing jobs and hours of work, so expanding the EITC and CTC for tax year 2020 would help cushion that economic shock and keep families above the poverty line. What’s more, refunds from these credits will put more resources in cash-strapped families’ hands, which they are likely to use to pay bills or rent, or for other necessities. That spending will boost local economies, mitigating the effects of recessions and preventing job loss.

Bottom line: if Republican senators are looking for tax policies that are targeted and would stimulate the economy—and increase racial and gender equity—expanding the EITC and CTC, as in the House-passed HEROES Act, is the way to go.