Abortion rights, women of color, and LGBTQI+ people are under attack. Pledge to join us in fighting for gender justice.

The Senate Just Passed a #BadDealforWomen, But We’re Not Done Fighting

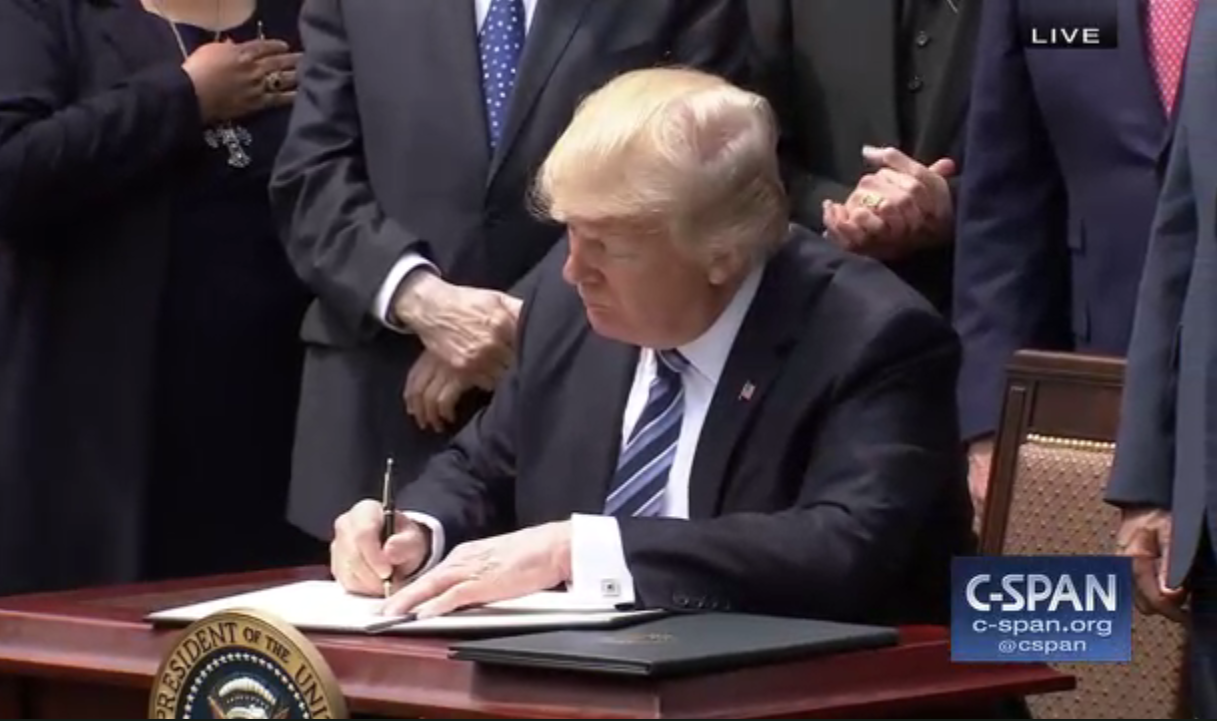

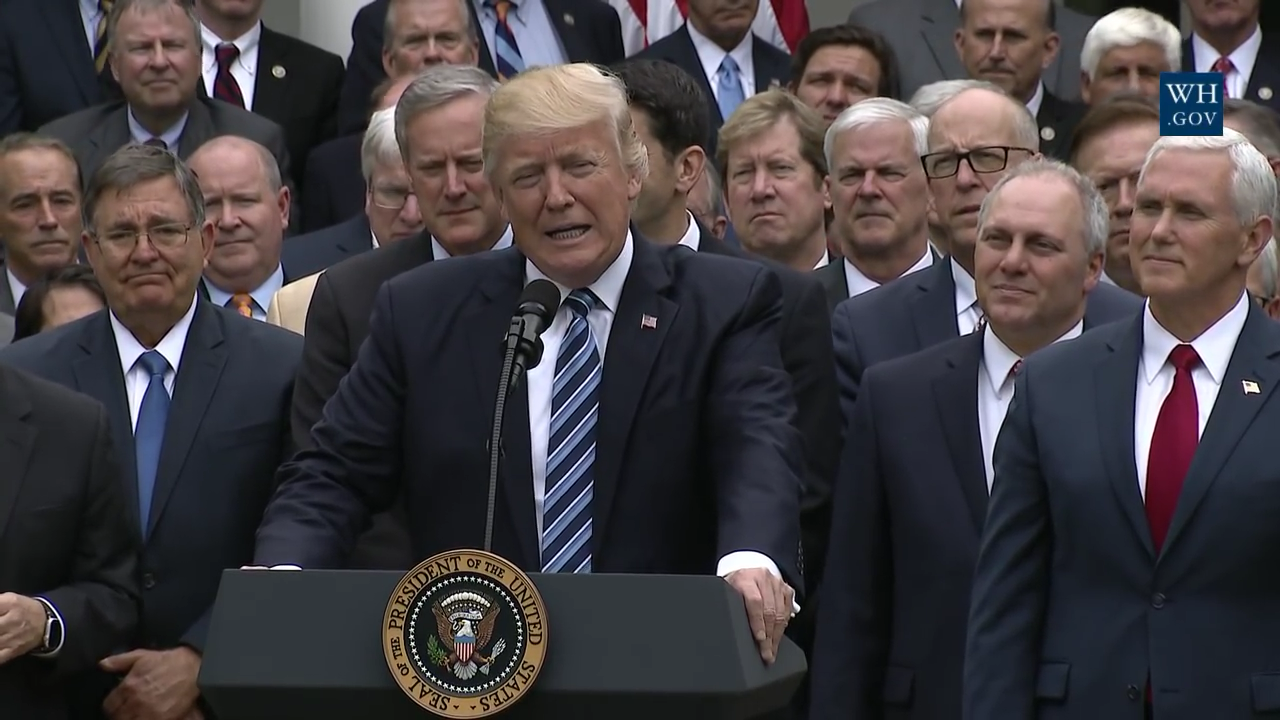

In the wee hours of Saturday morning, the Senate voted 51-49 to pass its version of the “Tax Cuts and Jobs Act,” which would make women and families pay for tax cuts to millionaires, billionaires, and corporations. Not only will millions of families see their taxes go up, but the tax plan would cost $1.5 trillion over 10 years – resulting in cuts to Medicare, Medicaid, public education, child care, and other vital programs and services that are essential to the economic security of women and families.

In the wee hours of Saturday morning, the Senate voted 51-49 to pass its version of the “Tax Cuts and Jobs Act,” which would make women and families pay for tax cuts to millionaires, billionaires, and corporations. Not only will millions of families see their taxes go up, but the tax plan would cost $1.5 trillion over 10 years – resulting in cuts to Medicare, Medicaid, public education, child care, and other vital programs and services that are essential to the economic security of women and families.

Even though poll after poll after poll shows that Americans do not support this terrible tax plan, Senate Republicans rushed the bill through. After a flurry of negotiations last week, the Republican leaders of the Senate forced a vote mere hours after circulating 479 pages of amended legislative language with handwritten notes in the margins. And the end result of the negotiations and amendments? A bill even more skewed to the wealthy and corporations.

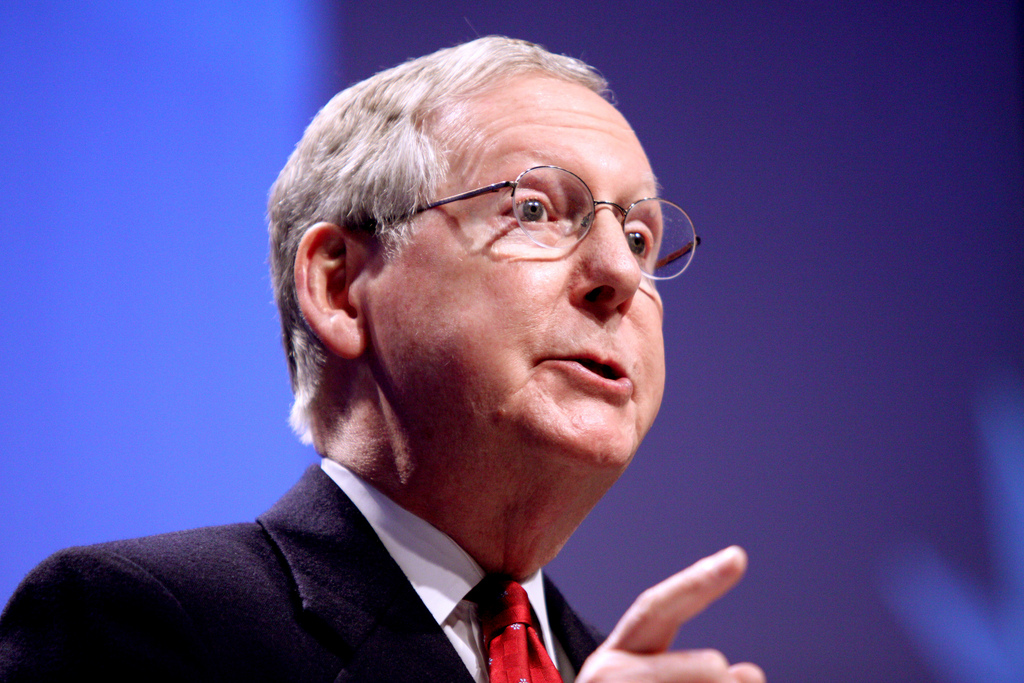

What’s worse, as it became clear that the Senate bill would pass, Republicans stopped trying to hide the fact that these enormous tax cuts will break the bank and that women and their families will be paying the bill for years to come. Senator Orrin Hatch, chair of the Senate Finance Committee, stated with a straight face after the tax bill passed that the Senate couldn’t reauthorize a health insurance program for low-income children (CHIP) “because we don’t have money anymore.” And Republicans like Senator Marco Rubio announced their intention to go after Social Security and Medicare, to pay for these exorbitant tax cuts to the rich.

In fact, the tax cuts may result in immediate cuts to Medicare and other key programs. Increasing the deficit (as the Senate bill would do) triggers federally mandated cuts under Congress’s “pay-as-you-go” rule (or PAYGO). The price of this tax plan would trigger $150 billion in cuts to domestic programs each year for a decade—including $25 billion from Medicare. Even if Congress waives the PAYGO rule later this month, critical programs for women and families are still threatened.

We can still stop this tax plan, but we must act NOW!

There are differences between the House and Senate versions of the bill. One very significant difference is the Senate bill’s attempt to gut the ACA. The bills also differ on whether the tax cuts for individuals are temporary or permanent, the timing of the corporate tax cuts, and treatment of pass-through business income. The House bill proposes repealing the medical expenses deduction, which benefited 8.8 million taxpayers with high health care costs in 2015. The House bill also proposes eliminating education tax benefits such as the student loan interest deduction, tuition waivers for graduate students, and some higher education tax credits. The House and Senate proposals to change the Child Tax Credit, both of which are insufficient to help the low-income families who need it the most, also differ.

These and other differences necessitate a conference committee process so that the two chambers can reconcile the differences in their bills. Then the House and the Senate will both have to vote on the conference version of the bill. Given the speed with which Congressional Republicans have pushed the previous versions of the bill forward and the pressure to pass a bill by Christmas, we only have DAYS left to stop these reckless tax cuts for the super wealthy at the expense of women and families.

Call your Members of Congress to tell them that the Tax Cuts and Jobs Act is a bad deal for women and families!

(202) 224-3121

Not sure what to say? Access our handy talking points here!

This tax bill will have monumental consequences for decades to come, so a deliberate discussion of what’s in the bill and the impact it would have is critically important – and there’s actually no need for Congress to rush to get it done this month. In contrast, there are things on Congress’ plate that have real deadlines – like the CHIP program, which expired IN SEPTEMBER. And did we mention that government funding will run out in December without Congressional action? Or that nearly 800,000 Dreamers risk losing their legal status unless Congress passes the DREAM Act? OR that Puerto Rico, the Virgin Islands, Texas, Florida, and California need disaster relief to deal with the aftermath of the hurricanes and wildfires?

All we want for Christmas is for Congress to do its job, and address what women and their families need right now – which is absolutely NOT a tax bill that would make them pay for massive tax cuts for millionaires, billionaires, and corporations.